GOLD & CRUDE OIL TALKING POINTS:

- Gold prices drop as Cisco, Walmart results temper trade war fears

- Crude oil prices rise with stocks as sentiment brightens market-wide

- Unexpected US vs China news-flow may trigger knee-jerk volatility

Gold prices dropped as bond yields rose alongside the US Dollar, sapping the appeal of non-interest-bearing and anti-fiat assets. What’s more, stocks rose in tandem, pointing to a risk-on backdrop. Sentiment-linked crude oil prices tellingly followed shares upward.

These moves mark a stark departure from risk on/off dynamics prevailing across markets recently, evoking rosier times in 2016 and the earlier part of 2018. Rosy earnings reports from Walmart and Cisco – which heartened traders tortured by trade war jitters – appeared to be the catalysts at work.

TRADE WAR HEADLINES MENACE MARKETS, US CONSUMER CONFIDENCE DATA DUE

Looking ahead, the University of Michigan measure of US consumer confidence headlines an otherwise quiet economic data docket. That is expected to print broadly in line with the prevailing trend over recent years, with only a dramatic deviation likely to materially alter the Fed policy outlook.

That might reinforce the central bank's standstill stance, which could cool risk appetite a bit. Policymakers’ wait-and-see approach is well known at this point however and is probably priced in for the most part. That may derail meaningful follow-through, making for a consolidative session overall.

Headline risk amid escalating US-China trade war tensions is an obvious wildcard in this scenario. Combative tweets from US President Donald Trump and countervailing comments from Beijing have proven to be market-moving of late and may yet trigger kneejerk volatility again.

Did we get it right with our crude oil and gold forecasts? Get them here to find out!

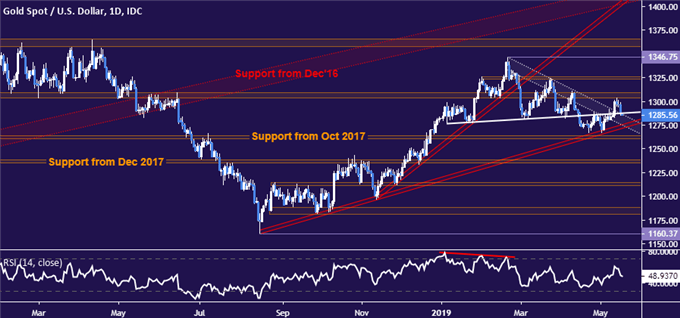

GOLD TECHNICAL ANALYSIS

Gold prices pulled back from resistance in the 1303.70-09.12 area to retest the recently broken upper bound of the downtrend from late February highs, now recast as support. This is reinforced by a dense block of reinforcing levels extending down to 1260.80. Confirming a break below this on a daily closing basis targets the 1235.11-38.00 region next.

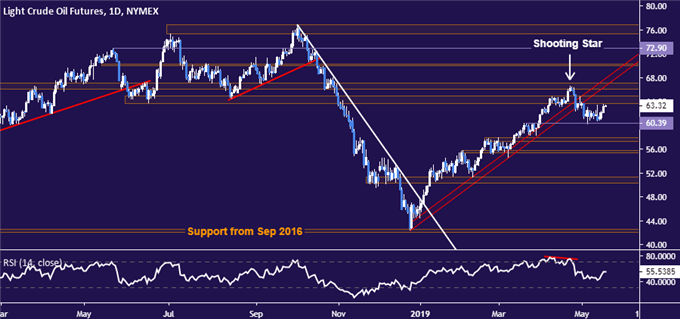

CRUDE OIL TECHNICAL ANALYSIS

Crude oil prices bounced to test the top of their recent range. Resistance begins at 63.59 but a layer of overlapping topside barriers runs from there all the way up to 67.03. A daily close above that sets the stage for a retest of the $70/bbl figure. Alternatively, a drop below support at 60.39 opens the door for a challenge of the 57.24-88 area.

COMMODITY TRADING RESOURCES

- See our guide to learn about the long-term forces driving crude oil prices

- Having trouble with your strategy? Here’s the #1 mistake that traders make

- Join a Trading Q&A webinar to answer your commodity market questions

--- Written by Ilya Spivak, Currency Strategist for DailyFX.com

To contact Ilya, use the comments section below or @IlyaSpivak on Twitter