US Labor Report (NFPs) Release and US Dollar (DXY) Price Analysis and Charts.

- US NFPs shows 263,000 new jobs created in April

- US Dollar (DXY) mixed on headline beat and wages miss.

DailyFX Q2 Forecasts and Top 2019 Trading Opportunities.

*** US Non-Farm Payrolls – Update to Follow Shortly ***

The April US Labor Report (NFPs) reported job growth of +263K beating expectations of +190k and a prior revised number of +189k from +196k

The US dollar (DXY) jumped on the headline beat but slipped back while EURUSD fell to its lowest level of the day before paring losses.

The closely watched average hourly earnings m/m increase of 0.2% compared to expectations of 0.3% and a revised higher reading of 0.2% recorded in March, while annual average hourly earnings missed expectations at 3.2% compared to 3.3% and a prior reading of 3.2%.

US Department of Labor – Full Labor Report

NFP and Forex: Non-Farm Payrolls and How to Trade It

US Dollar (DXY) One-Minute Price Chart (May 3, 2019)

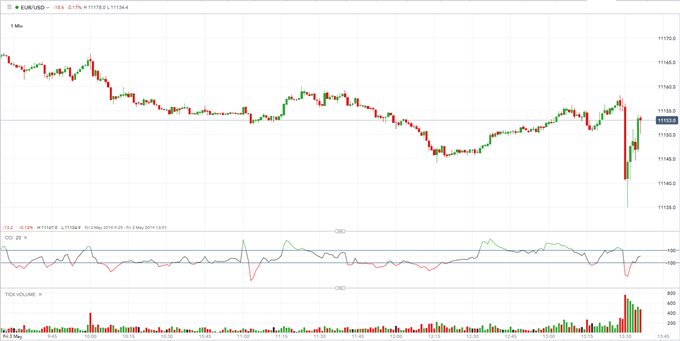

EURUSD One-Minute Price Chart (May 3, 2019)

IG Client Sentiment shows how retail traders are positioned in a wide range of asset classes and how daily and weekly sentiment changes can help drive momentum.

--- Written by Nick Cawley, Market Analyst

To contact Nick, email him at nicholas.cawley@ig.com

Follow Nick on Twitter @nickcawley1