EURUSD Price, Chart and Analysis:

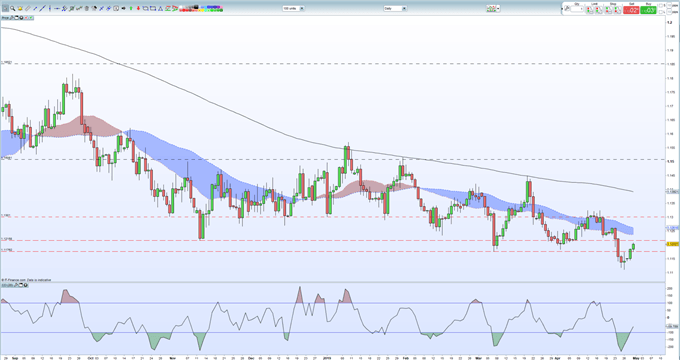

- EURUSD may be starting a small corrective wave higher within a longer-term downtrend.

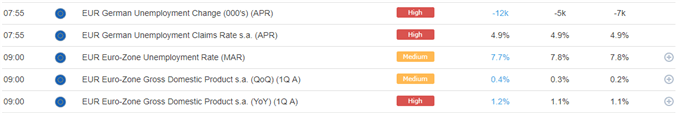

- Euro-Zone GDP edges higher, German inflation may beat expectations.

Q2 2019 EUR Forecast and USD Top Trading Opportunities

EURUSD remains within a noted downtrend but may be looking to continue its recent correct bounce higher with the 1.1200 handle in already broken. Today’s Euro-Zone q/q GDP data came in marginally better-than-expected - 0.4% vs 0.3% expectations and 0.2% prior - while recent indications are that German CPI later today may also surprise to the upside after recent regional results. Earlier in the session, German unemployment data also beat expectations, adding another positive EURUSD impulse.

The current positive momentum in EURUSD may see last Wednesday’s 1.1224 level come under pressure before the 20- and 50-day moving averages at 1.1236 and 1.1261 come into view. The CCI indicator shows the pair moving sharply out of oversold territory. EURUSD needs to break and close above the recent double-top at 1.1325 to gain further momentum.

EURUSD Daily Price Chart (August 2018 – April 30, 2019)

Retail traders are 62.9% net-long EURUSD according to the latest IG Client Sentiment Data, a bearish contrarian indicator. However recent daily and weekly positional changes give us a mixed trading bias.

We run several Trader Sentiment Webinars every week explaining how to use IG client sentiment data and positioning when looking at a trade set-up. Access the DailyFX Webinar Calendar to get all the times and links for a wide range of webinars.

Traders may be interested in two of our trading guides – Traits of Successful Traders and Top Trading Lessons – while technical analysts are likely to be interested in our latest Elliott Wave Guide.

What is your view on EURUSD – bullish or bearish? You can let us know via the form at the end of this piece or you can contact the author at nicholas.cawley@ig.com or via Twitter @nickcawley1.