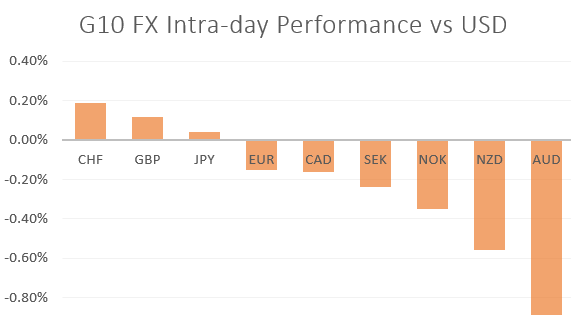

MARKET DEVELOPMENT – Euro Breakout in Focus, AUDUSD Plummets as Soft CPI Fuels Rate Cut Talk

AUD: The Australian Dollar is the notable underperformer, having dropped to session lows following the softer than expected inflation report overnight. The RBA’s preferred measure of inflation (trimmed mean) continues to reside below the RBA’s 2-3% target band and has done since Q4 2015. In light of the CPI inflation report, rate cut expectations jumped to 65% at the upcoming May meeting with a flurry of banks also joining the rate cut party. However, as a reminder, the recent jobs report continues to shine a bright torch in the dim domestic outlook for Australia, which may be enough to see the RBA postpone on a rate cut.

EUR: As the greenback continues to edge higher, the Euro is back towards critical support, with the pair hovering slightly above the 2019 lows (1.1176), in which a break below could pave the way for deeper losses in EURUSD with a 1.10 handle in sight. Data in the Eurozone remains weak as evidenced by the latest German IFO survey missing economic forecasts. German 10yr bund yields are back into negative territory, while the spread against the US 10yr has widened once again, consequently, this does not bode well for Euro buyers.

Source: Thomson Reuters, DailyFX

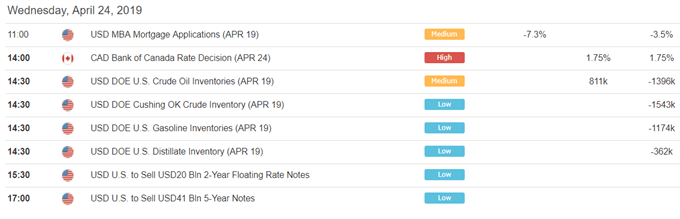

DailyFX Economic Calendar: – North American Releases

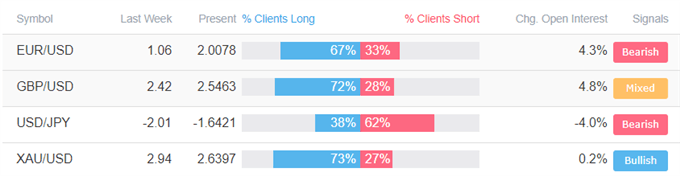

How to use IG Client Sentiment to Improve Your Trading

WHAT’S DRIVING MARKETS TODAY

- “Gold Price at Trend-line Support, Silver Price Pattern Near Triggering” by Paul Robinson, Currency Strategist

- “GBPUSD Price Battling Brexit Division and US Dollar Dominance” by Nick Cawley, Market Analyst

- “Canadian Dollar Technical Analysis Overview: USDCAD, CADJPY, GBPCAD” by Justin McQueen, Market Analyst

- “Crude Oil Price Outlook: Correction Lower May Be Short-Lived” by Martin Essex, MSTA , Analyst and Editor

- “Using FX To Effectively Trade Global Market Themes at IG” by Tyler Yell, CMT , Forex Trading Instructor

--- Written by Justin McQueen, Market Analyst

To contact Justin, email him at Justin.mcqueen@ig.com

Follow Justin on Twitter @JMcQueenFX