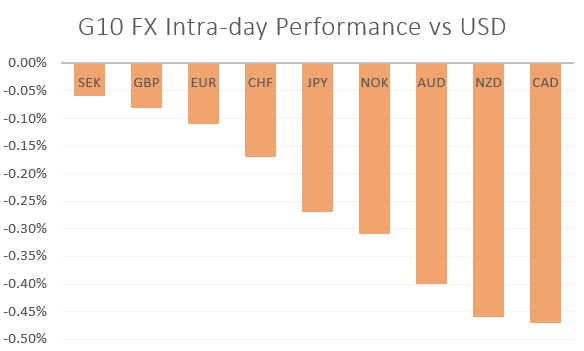

MARKET DEVELOPMENT – USD is King in Low Currency Volatility Environment, Gold Drops Below Support

USD: Despite the risk events throughout the week, FX volatility has been very subdued and continues to do so, with the most traded currency, EURUSD, seeing implied volatility hovering around record lows (1-month vols). Consequently, in this period of low volatility USD remains firm given the attractiveness that carry trades provide, while the fundamental backdrop for the US economy is notably stronger than the Eurozone. With little on the docket, eyes will turn to the Fed speak later today.

GBP: Given that an extension had largely been priced in and the outlook remains unchanged, GBP subsequently failed to find a renewed bid after the announcement. As a reminder, speculative positioning had been relatively neutral, according to the latest COT update, which in turn suggested that a short squeeze would be unlikely. However, while an extension may help GBPUSD hold support at 1.30, uncertainty will persist with a wide range of outcomes still possible (general election, second referendum, Theresa May resignation).

Risk Currencies (AUD, NZD, CAD): Risk sensitive currencies are the notable underperformers this morning against the greenback with the Canadian Dollar feeling the pressure from the pullback in oil prices. In turn, USDCAD is back to familiar resistance at 1.3385-1.34.

Gold: As the USD stabilises around the 97.00 handle, gold prices have taken a slight knock with the precious metal dropping back below the 1300 level. Demand for the precious metal has also been dampened by the mild support for equity markets.

Source: Thomson Reuters, DailyFX

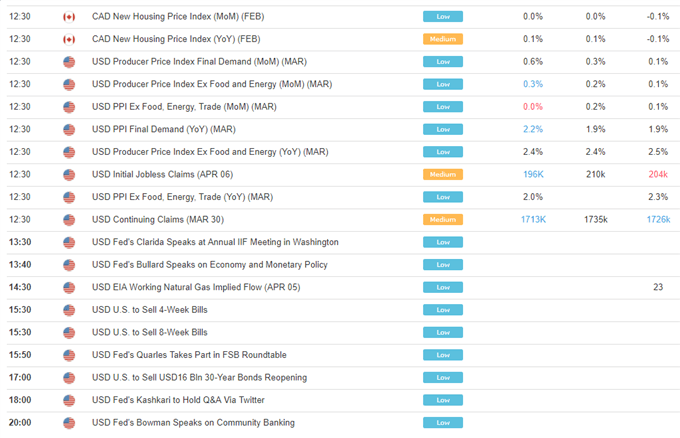

DailyFX Economic Calendar: – North American Releases

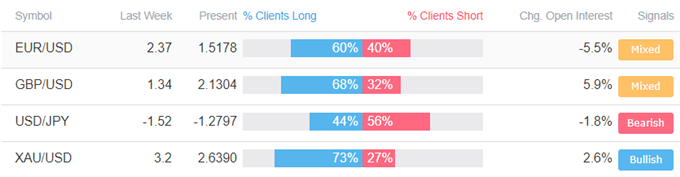

How to use IG Client Sentiment to Improve Your Trading

WHAT’S DRIVING MARKETS TODAY

- “GBPUSD Price Shrugs Off Brexit Extension, Sterling’s Bid Remains” by Nick Cawley, Market Analyst

- “Gold Price Outlook Still Positive as Global Slowdown Fears Persist” by Martin Essex, MSTA , Analyst and Editor

- “S&P 500 Outlook: Investors on Edge Ahead of Earning Season” by Justin McQueen, Market Analyst

- “FTSE Technical Outlook Following Brexit ’Agreement’; GBP Correlation a Factor Again” by Paul Robinson, Market Analyst

- “Using FX To Effectively Trade Global Market Themes at IG” by Tyler Yell, CMT , Forex Trading Instructor

--- Written by Justin McQueen, Market Analyst

To contact Justin, email him at Justin.mcqueen@ig.com

Follow Justin on Twitter @JMcQueenFX