GBPUSD Price, News and Analysis and Brexit Latest

- EU offers a six-month extension if needed.

- European Parliamentary Elections now in view.

Q2 2019 GBP Forecast and USD Top Trading Opportunities

British Pound Latest – Brexit and the Halloween Deadline

The EU and UK agreed to a six-month flexible extension of Brexit until October 31 or earlier if the UK signs off the Withdrawal Agreement. However, if the UK does not take part in the European Parliamentary Elections by May 31, then the UK will automatically be kicked out of the EU. If the UK signs off an agreement with the EU before May 31, then they will not have to take part in the election process.

This flexible extension means the possibility of the UK falling out of the EU this Friday has been averted although if history is anything to go by, the can has just been kicked further down the road. Neither side has made any shift in their negotiating stance, while all that is happening in the UK is that PM May’s position is becoming more untenable by the day. Labour and the Conservative party continue their cross-party talks but neither side has made any concessions, while the ruling Conservative party is being split apart by internal positioning and politicking.

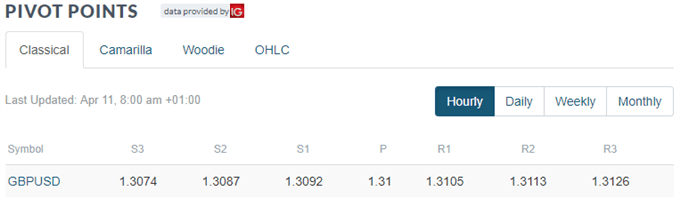

Sterling continues to hold a bid around the 1.3000 level against the US dollar despite this negative backdrop. While the immediate worry of falling out of the EU with a No Deal has passed for now, there has been no advance in negotiations. The UK Parliament is also in recess for its Easter break until April 23. The GBPUSD chart shows an ascending triangle formation from mid-March with a cluster of other technical indicators including the 20-, 50- and 200-day moving averages and the 38.2% Fibonacci retracement level at 1.3177. The CCI indicator has made a break from its recent downtrend but remains weak overall.

Sterling (GBP) Fundamental Outlook: Leaning Towards a Softer Brexit?

Sterling Weekly Technical Outlook: GBPUSD & EURGBP Trends Creaking.

GBPUSD Daily Price Chart (July 2018 – April 11, 2019)

Retail traders are 69.0% net-long GBPUSD according to the latest IG Client Sentiment Data, a bearish contrarian indicator. See how recent daily and weekly positional changes affect GBPUSD sentiment.

Traders may be interested in two of our trading guides – Traits of Successful Traders and Top Trading Lessons – while technical analysts are likely to be interested in our latest Elliott Wave Guide.

What is your view on Sterling – bullish or bearish?? You can let us know via the form at the end of this piece or you can contact the author at nicholas.cawley@ig.com or via Twitter @nickcawley1.