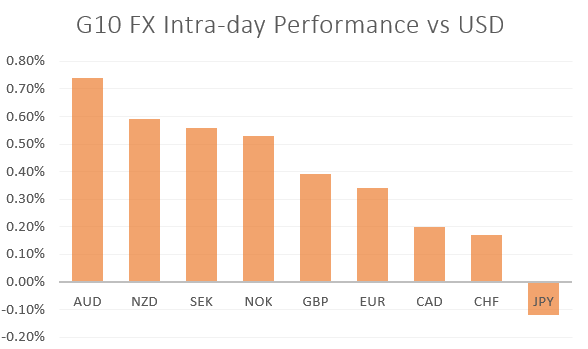

MARKET DEVELOPMENT –AUDUSD, GBPUSD, EURUSD Recover as USD Suffers from Risk On Sentiment

EUR: The Euro and German yields had been underpinned this morning by a slew of better than expected services PMI figures from the Eurozone. Elsewhere, Brexit is continuing to move towards a softer direction following Theresa May’s reach out to Labour Leader Jeremy Corbyn. However, risks to the Euro-Area continue to remain tilted to the downside, while CFTC data continues to show that investors remain bearish on the Euro with net shorts valued at over $11bln.

GBP: The Pound is trading with modest gains after Theresa May reached out to Jeremy Corbyn to reach a Brexit compromise. However, GBPUSD fell short of breaking above the 1.32 handle after a surprisingly weak services PMI report, which had fell into contractionary territory, hitting its lowest level since July 2016. GBP remains volatile and will continue to do so until the Brexit uncertainty clears.

AUD: Risk on currencies and in particular the Aussie is notably firmer this morning with talk of a softer Brexit and US/China trade talks making headway for a deal lift sentiment. Alongside this, the Aussie had also found comfort from better than expected retail sales and trade data. However, with a cluster of DMA from 0.7120-0.72 further upside may be somewhat limited.

Source: Thomson Reuters, DailyFX

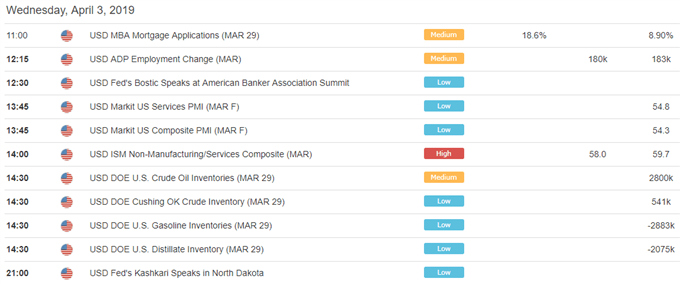

DailyFX Economic Calendar: – North American Releases

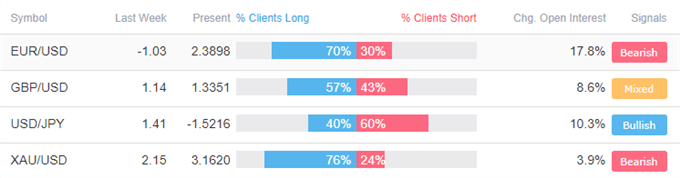

How to use IG Client Sentiment to Improve Your Trading

WHAT’S DRIVING MARKETS TODAY

- “Bitcoin (BTC) Price Outlook: A New Rally Simmering or a Bull Trap?” by Nick Cawley, Market Analyst

- “EURUSD Bounces Off Support on Firm Data and Softer Brexit Hopes” by Justin McQueen, Market Analyst

- “S&P 500 Rising Wedge Chart Pattern, Dow Still Trying to Clear Resistance” by Paul Robinson , Market Analyst

- “Crude Oil Price Outlook Positive After Break Higher” by Martin Essex, MSTA , Analyst and Editor

- “Using FX To Effectively Trade Global Market Themes at IG” by Tyler Yell, CMT , Forex Trading Instructor

--- Written by Justin McQueen, Market Analyst

To contact Justin, email him at Justin.mcqueen@ig.com

Follow Justin on Twitter @JMcQueenFX