Market Themes and Movers

GBP: A series of indicative votes later in the Parliament may give Sterling some direction for the rest of the week but as with all things Brexit, nothing can be ruled in or out. Before MPs get to vote, a list of 16 options will be whittled down by Speaker of the House John Bercow, which may ruffle a few feathers. GBPUSD trades flat on the session with the US dollar stable and waiting for important data releases at the back end of the week.

NZD: The RBNZ turned dovish at its latest policy where rates were left unchanged as expected. The surprise came in the accompanying statement with the central bank admitting that interest rates may need to be cut in the months ahead due to slowing growth and below target inflation. The New Zealand dollar lost around 1.5% against a range of currencies in the minutes after the release and continues to trade heavy.

EUR: At an ECB conference in Frankfurt, central bank President Mario Draghi again highlighted that concerns over a lack of price pressure and global growth worries. The single currency weakened marginally as Draghi repeated that all monetary options remain open. In the Euro-Zone bond market, Germany sold 10-year Bunds with a negative yield for the first time since 2016, underscoring fears of tepid growth ahead.

US yield curve inversion – short-term rates above long-term rates - is all the rage at the moment as markets toy with the idea that a recession is on the way. Excellent primer by DailyFX senior currency strategist Chris Vecchio:

Why Does US Yield Curve Inversion Matter?

10-Year German Bunds – Paying Germany to Lend Them Money

DailyFX Economic Calendar: For updated and timely economic releases.

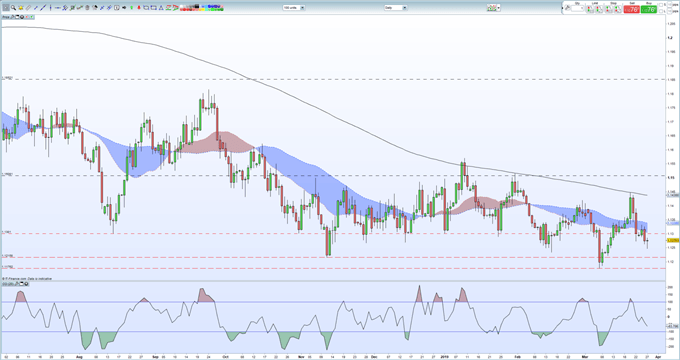

EURUSD Daily Price Chart – Downtrend Remains Intact (March 27, 2019)

How to use IG Client Sentiment to Improve Your Trading

Retail sentiment is an important tool for any trader to help gauge market sentiment and positioning. We provide updated daily and weekly positional changes on a wide range of currencies and asset classes to help decision making.

Market Movers with Updated News and Analysis:

- GBPUSD Outlook: Brexit Voting in Parliament to Dominate Trading.

- EURUSD Price Remains Under Pressure, ECB’s Draghi Reiterates Downside Risks.

- NZDUSD Tumbles Through Support as RBNZ Hints Rate Cut as Next Move.

- S&P 500 and Dow Jones May be Working Towards Tradeable Formations.

- Top 5 FX Events: Third Brexit Vote & GBPJPY Price Outlook.

--- Written by Nick Cawley, Market Analyst

To contact Nick, email him at Nicholas.Cawley@ig.com

Follow Nick on Twitter @nickcawley1