Brexit, British Pound Talking Points

- British Pound soars, Theresa May’s Deputy says government secured Brexit deal changes

- All eyes next on vote in Parliament, rejection would imply more uncertainty

- GBP/USD still lacking technical bullish break, EUR/GBP eyes May 2017 low

Trade all the major global economic data live and interactive at the DailyFX Webinars. We’d love to have you along.

The British Pound rallied against its major counterparts in early Tuesday trade following the latest Brexit news. Theresa May’s Deputy, David Lidington, said that the government secured ‘improved’ changes to her Brexit deal ahead of today’s vote on it. Shortly after this update, it was confirmed that Parliament will proceed with the vote on May’s divorce deal, which was previously defeated by a historical margin.

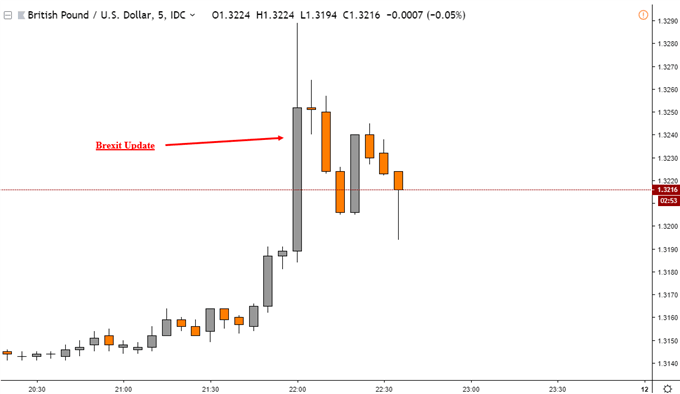

In a week that is expected to see intense Sterling volatility, GBP/USD rallied as much as 0.5% on the update which you can see on the immediate chart below. Mr. Lidington added that that the entire UK Cabinet approved the Brexit deal improvements, adding that the choice later today is either this deal or ‘political crisis’. After the news, GBP/USD pared gains as Tory MP, Steve Baker, said that the changes fall ‘far short’.

GBP/USD Brexit News Reaction

Soon after, EU Commission Chief, Jean-Claude Juncker, began a press conference with the UK Prime Minister. He said that ‘it is this deal, or Brexit may not happen at all’. Mr. Juncker added that the United Kingdom must leave by May 23 or hold elections. He also urged the remaining 27 EU nations to endorse the new documents on Brexit.

With that in mind, all eyes now turn to the remaining 24 hours as the world awaits the vote on Theresa May’s updated Brexit deal. In the press conference with Juncker, she said that she stands by what the Brexit deal achieves. As for the important Irish backstop provision, she said that it cannot become a permanent arrangement.

GBP/USD has generally been rallying in the lead-up to this vote on hopes that Brexit could get delayed. With the EU now solidifying its stance, a rejection of the updated deal could bring about more uncertainty, boding ill for Sterling. Especially after Mr. Juncker noted that ‘there will be no new negotiations’ on Brexit.

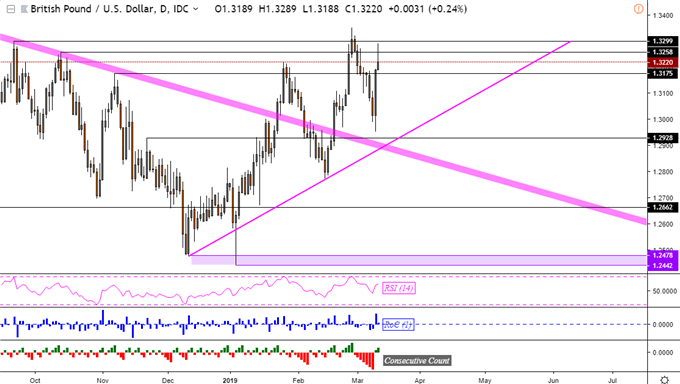

GBP/USDTechnical Analysis

A clear technical break in GBP/USD is still absent, not surprising given the important Brexit votes in Parliament that are still due this week. Most notably, near-term resistance at 1.3258 and 1.3299 held. Clearing the latter opens the door to resuming the dominant uptrend from December. Meanwhile, support seems to be at 1.3175 followed by 1.2928.

GBP/USD Daily Chart

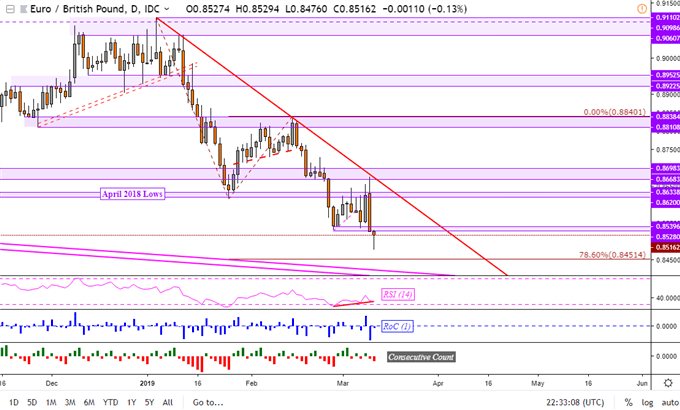

EUR/GBP Daily Chart

Despite fading downside momentum, EUR/GBP is eyeing its lowest close since May 2017. If confirmed, we may aim for lows achieved back in 2016/2017 around 0.8337. However, if prices recover by the end of the day to finish little change, there is the risk of a hammer forming at the bottom. With confirmation, this indecision can precede a turn higher which leaves resistance at 0.862.

EUR/GBP Technical Analysis

*Charts Created in TradingView

British Pound Trading Resources

- Just getting started? See our beginners’ guide for FX traders

- Having trouble with your strategy? Here’s the #1 mistake that traders make

- See how the Pound is viewed by the trading community at the DailyFX Sentiment Page

--- Written by Daniel Dubrovsky, Junior Currency Analyst for DailyFX.com

To contact Daniel, use the comments section below or @ddubrovskyFX on Twitter