US Equity Market Update - Talking Points:

- The US stock market is coming under pressure after manufacturing and consumer sentiment data both miss expectations

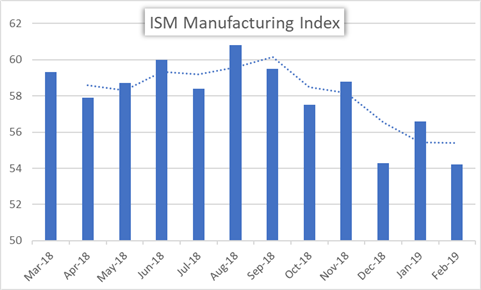

- February’s ISM Manufacturing Index fell to 54.2 while UofMich Consumer Sentiment ticked up slightly to 93.8

- New to trading? Download the free DailyFX Education guide on Trading the News for Beginners!

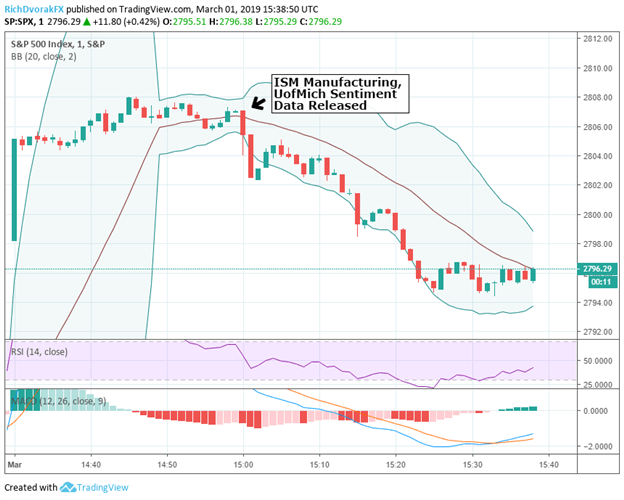

Weak economic numbers are putting pressure on US markets this morning as investors grow weary about the resilience of America’s economy. Following the release of the data, stocks began to erase their gains from the open.

S&P500 INDEX PRICE CHART: 1-MINUTE TIME FRAME (MARCH 01, 2019 INTRADAY)

With the US Manufacturing PMI missing expectations of 56.0, fears of slowing economic growth could quickly resurface and tighten financial conditions as witnessed December of last year.

The ISM report for February showed that growth in new orders, production and employment slowed while inventories, order backlog, new export orders and imports expanded at a faster pace. On the other hand, prices decreased at a faster pace changing 0.2 percentage points from 49.6 to 49.4 over the period. Also, supplier deliveries slowed albeit at a slower rate compared to the January ISM Manufacturing Index report.

ISM MANUFACTURING INDEX FEBRUARY 2019

Although the manufacturing sector and overall economy have respectively expanded for 30 and 118 consecutive months, the slower pace is a concern for the markets and could begin to reignite fears that the U.S. economy may not be immune to the global slowdown.

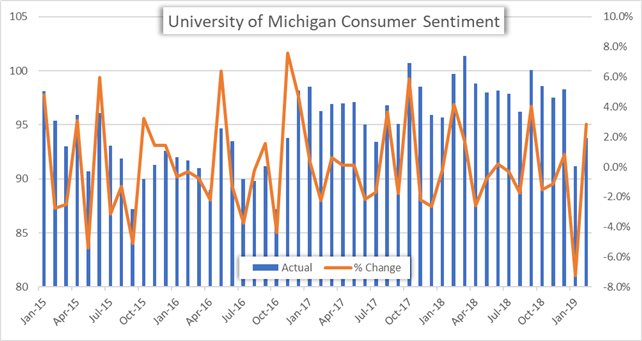

Over-optimism also showed up in readings from University of Michigan’s Consumer Sentiment Survey which missed expectations of 95.8, but the gauge did show improvement from January’s report.

UNIVERSITY OF MICHIGAN CONSUMER SENTIMENT SURVEY FEBRUARY 2019

Despite the indicator’s marginal recovery, consumer sentiment remains 5.9 percent lower year-over-year. Also concerning was the expected change in real income for the middle income category who are anticipating a noticeable 1.9 percent decline from 2018 to 2019.

Take a look at the articles below for more insight on what’s happening in the markets:

- Sterling (GBP) Nudges Higher, Brexit Vote Could Be Pushed Forward

- US Dollar Struggles for Footing; Gold Loses Uptrend from Late-November

---

Written by Rich Dvorak, Junior Analyst for DailyFX

Follow on Twitter @RichDvorakFX

Check out our Education Center for more information on Currency Forecasts and Trading Guides.