TALKING POINTS:

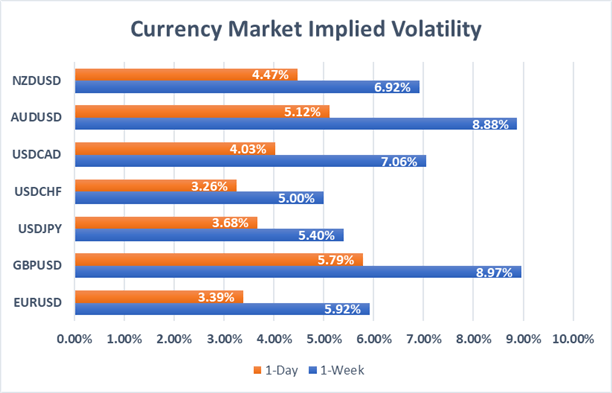

- 1-week USDCAD implied volatility creeps up while GBPUSD implied volatility remains elevated on the back of Brexit risk

- AUDUSD looks ripe for price action with Australian GDP and RBA interest rate decision

- Looking to sharpen your forex trading strategy? Download the free DailyFX Top Trading Lessons Guide!

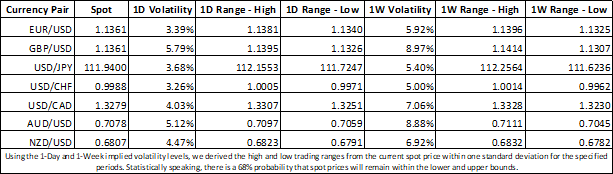

Awareness of implied volatility aids forex traders in predicting the possible magnitude of spot price movements. Expected volatility can be used to calculate trading ranges that provides an estimate for how high or low a currency might move over the given period which is useful for hedging and setting effective limit orders. So what is the forex option market expecting next week for NZDUSD, AUDUSD, USDCAD, USDCHF, USDJPY, GBPUSD and EURUSD?

FOREX MARKET IMPLIED VOLATILITY AND TRADING RANGES

The drawdown in 1-week implied volatilities over the last few trading days could be signaling a ‘calm before the storm.’ Weak economic data that has been crossing the wires as of late could eventually turn sentiment and quickly accelerate price action. This generally causes volatility to spike.

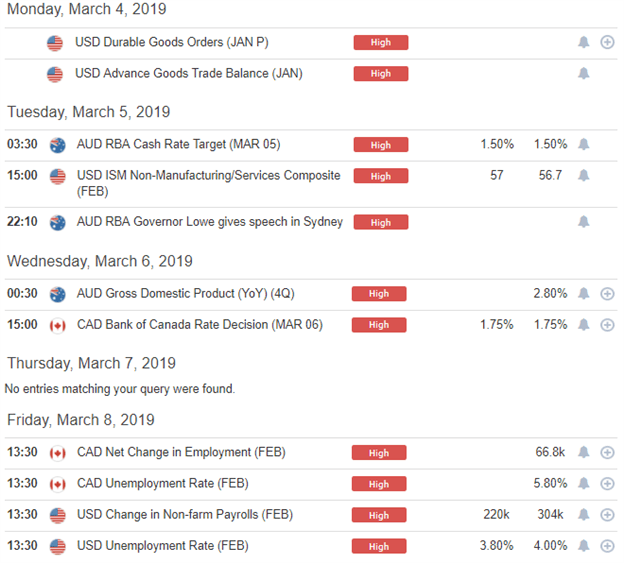

UPCOMING AUDUSD, USDCAD ECONOMIC DATA AND EVENT RISK

Want to see a comprehensive list of economic data releases and event risk? Check out the free DailyFX Economic Calendar updated in real-time!

AUDUSD looks ripe for some price action on Tuesday with the Reserve Bank of Australia interest rate decision and Governor Lowe’s follow-up speech. Although markets are widely expecting the RBA to keep the cash target rate on hold at 1.5 percent, the central bank’s leader may provide insight on the future direction of Australia’s monetary policy. The ISM Services Index could also impact the currency pair if the reading warrants a reaction in the USD which follows a disappointing report on the manufacturing sector released earlier today.

Additionally, USDCAD could see some sizeable swings with the Bank of Canada slated to announce any changes in its interest rate outlook with the accommodating press release providing a check-up on the country’s economy. Friday could also bring about some volatility for USDCAD traders with employment data out of the two countries on deck for release.

---

Written by Rich Dvorak, Junior Analyst for DailyFX

Follow on Twitter @RichDvorakFX

Check out our Education Center for more information on Currency Forecasts and Trading Guides.

https://twitter.com/RichDvorakFX