Australian Dollar, Wage Data, Talking Points:

- AUD/USD slipped after as-expected wage expansion was revealed for 2018’s last quarter

- The bar for Aussie data to impress looks quite high now

- These numbers offer little hope that inflation will pick up

First-quarter technical and fundamental forecasts from the DailyFX analysts are out now.

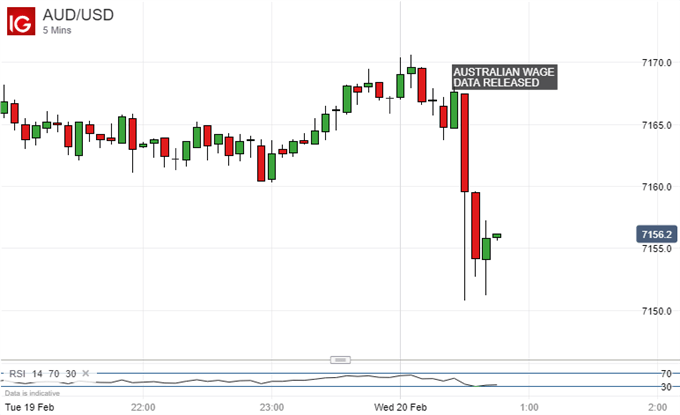

The Australian Dollar wilted noticeably Wednesday in the aftermath of wage data which on the face of it were exactly as expected.

Fourth quarter wages for 2018 expanded by 2.3% annualized, exactly as expected and the same as the previous three-month period. On the quarter they were up by 0.5%, just below the 0.6% expected.

AUD/USD’s skid after the numbers suggests that the bar for Australian data to impress might now be quite high in light of the Reserve Bank of Australia’s admission this month that record-low interest rates could yet fall further.

Sluggish wage growth clearly has a pass-through effect into consumption and inflation. The latter remains stubbornly weak and, on the thesis that current wage levels won’t move the dial on that at all, the Aussie’s reaction is explicable.

The impact may not last long, however. The Australian Dollar remains in thrall to overall risk appetite in the market, which is in turn driven often by headlines on trade talks between China and the US- a game in which the Australian economy has as much skin as any third-party.

Investors will also look to Thursday’s domestic employment data. Australia’s long run of impressive job creation is expected to continue, although its muted effect on inflation is expected to continue too, according to the RBA’s own forecasts.

Friday will so bring Parliamentary testimony from RBA Governor Philip Lowe. This could pose some risk to Aussie Dollar bulls, especially if he chooses to reiterate the price-boosting benefits of a weaker currency. He may well.

Resources for Traders

Whether you’re new to trading or an old hand DailyFX has plenty of resources to help you. There’s our trading sentiment indicator which shows you live how IG clients are positioned right now. We also hold educational and analytical webinars and offer trading guides, with one specifically aimed at those new to foreign exchange markets. There’s also a Bitcoin guide. Be sure to make the most of them all. They were written by our seasoned trading experts and they’re all free.

--- Written by David Cottle, DailyFX Research

Follow David on Twitter @DavidCottleFX or use the Comments section below to get in touch!