UK Markets including Sterling and FTSE analysis:

- Bad economic data and ongoing Brexit concerns hurt Sterling.

- US dollar strength also helps push GBPUSD lower.

We have released our Q1 2019 Trading Forecasts for a wide range of Currencies and Commodities, including GBPUSD along with our latest fundamental and medium-term term technical outlook.

Sterling (GBP) Starts the Week on the Backfoot

The British Pound is leaking lower across a range of currencies after the latest look at UK GDP showed a marked slowdown in Q4. While a slowdown had been expected by the market, the month-on-month figure of -0.4% was worse than all forecasts and once again pointed to a lack of progress in Brexit negotiations holding back the UK economy.

Additional UK hard data released this week may also add to the downward pressure on the British Pound which is nearing support levels against the US dollar and the Euro.

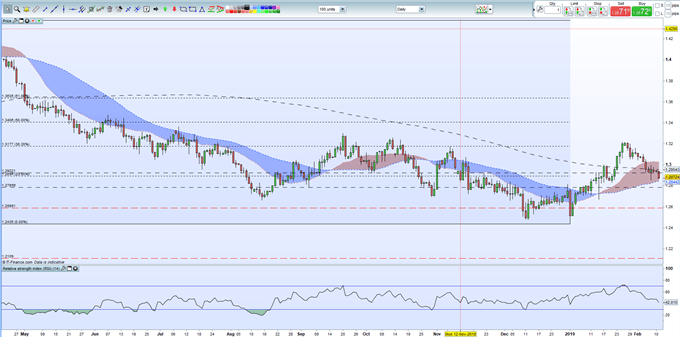

GBPUSD is also being steered lower by a strong US dollar that is currently trading at its 2019 high, despite fears that the US-China trade negotiations may not be making any headway. GBPUSD may test recent lows below 1.2830 and 1.2852 after recently falling through 23.6% Fibonacci retracement support at 1.2894.

GBP Fundamental Analysis: Dovish BoE, Brexit Hell

GBPUSD Daily Price Chart (May 2018– February 11, 2019)

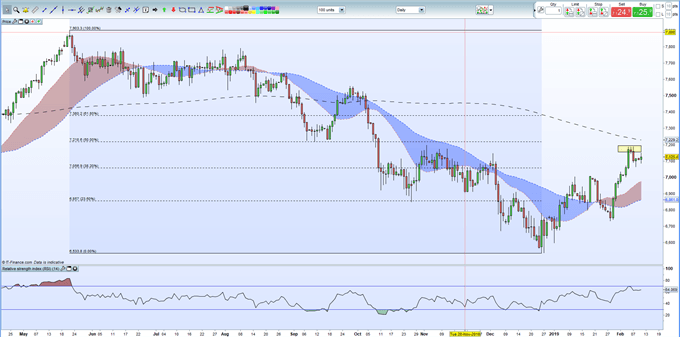

The FTSE 100 remains slightly better bid as the Pound falls, but further upside may be capped by last week’s triple-top around 7,180 and 7,190.

FTSE Chart Analysis – Resistance May Continue to Keep a Lid on the Market.

FTSE 100 Daily Price Chart (April 2018 – February 11, 2019)

IG Retail Sentiment data shows clients are 56.2% net-long GBPUSD, a bearish contrarian indicator. Traders are further net-long than yesterday and last week, and the combination of current sentiment and recent changes gives us a mixed trading bias.

--- Written by Nick Cawley, Analyst

To contact Nick, email him at nicholas.cawley@ig.com

Follow Nick on Twitter @nickcawley1