EURUSD analysis and the ECB:

- ECB President Draghi has a tricky hand to play

- French PMI suggest further economic woes ahead.

Q1 2019 Trading Forecasts including USD and EUR.

EURUSD Woes Continue Ahead of the ECB Meeting

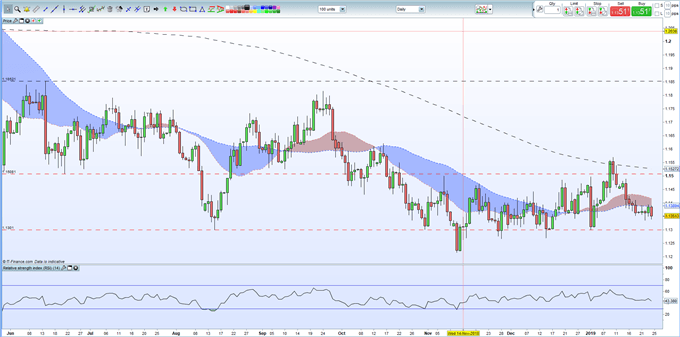

The single-currency is coming under renewed downside pressure ahead from another set of negative data releases and may choose to re-test the stubborn 1.1300 level sooner rather than later. And today’s ECB policy meeting is unlikely to stem the downward move with central bank President Mario Draghi expected to outline that monetary policy will remain loose for as long as necessary. Financial markets have now pushed back the first 10bp rate hike into 2020, while QE reinvestments may last for longer than originally expected.

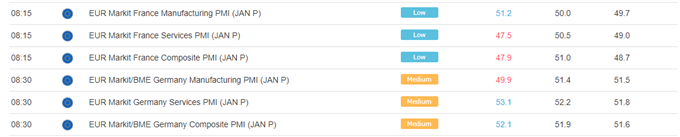

The latest set of Markit PMIs show the French economy continuing to suffer with their Composite index pointing to the quickest contraction in French private sector output for over four years. The German PMI data broke its recent run of successive falls, but Manufacturing output fell to 50-month low, hit by weakness in the auto industry and a slowdown of demand from China.

EURUSD remains unable to make a clean break through the 1.1300 area in 2019 despite the poor data seen over the past month. It may be that the ECB is defending this level in the face of adversity knowing that there may be worse news to come out of the EU. The technical set-up remains negative with the pair under all three moving averages, while the three-week low at 1.1335 is just a few pips away. The 1.1300 handle may prove difficult to break, but unless Mario Draghi pulls a rabbit out of his hat, the single-currency will break lower and make a fresh 19-month low under 1.1215 before moving towards the 61.8% Fibonacci retracement level at 1.1187.

IG Client Sentiment currently gives us a mixed trading bias despite retail data showing traders long EURUSD by a ratio of 1.87 to 1 (65.2%).

EURUSD Daily Price Chart (June 2018 – January 24, 2019)

Traders may be interested in two of our trading guides – Traits of Successful Traders and Top Trading Lessons – while technical analysts are likely to be interested in our latest Elliott Wave Guide.

What is your view on EURUSD – bullish or bearish?? You can let us know via the form at the end of this piece or you can contact the author at nicholas.cawley@ig.com or via Twitter @nickcawley1.