Sterling and Brexit Latest

- Sterling underpinned by growing Remain expectations.

- PM May playing a risky game – will it cost her job?

See how our Q1 2019 Trading Forecast for GBP can help you when trading.

Learn from our Mistakes!!!- Here are some of the top lessons DailyFX analysts learned, absorbed or suffered from personal experience in 2018.

PM May Warns That No Brexit is a Very Real Possibility

UK PM Theresa May will make her final round of pleas today ahead of tomorrow’s meaningful Brexit vote, saying that if MP’s reject her plan, then voter’s faith in democracy will be shattered. The PM goes into the vote in a vulnerable position with many commentators expecting her to lose by at least 100 votes. PM May will warn that if this happens then MPs from across the House will look to block a No Deal Brexit and extend negotiations with the EU. While this may open the door to a second referendum, a heavy defeat would also open the way for the opposition to call a vote of no confidence in the Prime Minister, potentially opening the way for a Labour government. Sterling traders see a Labour government as the worst-case scenario and would mark GBPUSD sharply lower if this came to pass.

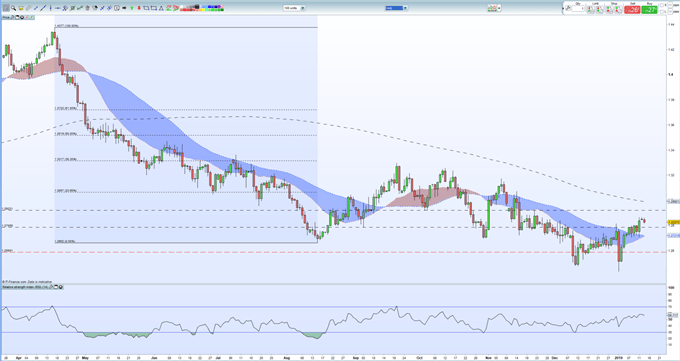

Sterling (GBP) has started the session flat to last week’s close and is currently being underpinned by thoughts that a second referendum would see the UK vote to stay in the EU. This would send the British Pound sharply higher with a longer-term re-trace back to the April 2018 high around 1.4375 a likely outcome. In the short-term the charts have turned a touch more bullish although technical analysis takes a backseat to fundamental analysis as we stand.

GBPUSD Weekly Technical Outlook: Light on the Horizon?

GBPUSD Daily Price Chart (March 2018 – January 14, 2019)

If you are interested in trading, or just curious about how and why market moves occur, we have recently produced a new guide – How to Start Trading: Top Tips and Guides for Beginners – to help you start your journey.

IG Client Retail sentiment data confirms a negative picture for the GBPUSD. Retail are 53.8% net-long the pair, a bearish contrarian indicator. However, recent daily and weekly positional suggest the GBPUSD may soon reverse higher.

What is your view on Brexit – bullish or bearish for Sterling?? You can let us know via the form at the end of this piece or you can contact the author at nicholas.cawley@ig.com or via Twitter @nickcawley1.