Australian Dollar, China CPI Talking Points:

- Chinese Consumer Price inflation posted its weakest rise since the middle of 2018 in December

- Factory gate prices were even weaker

- Beijing has little incentive to wind in stimulus on this score, but AUD focus was clearly elsewhere

First-quarter technical and fundamental forecasts from the DailyFX analysts are out now.

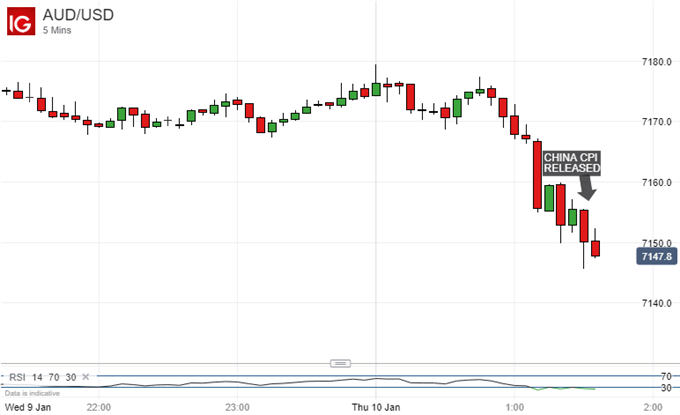

The Australian Dollar slipped Thursday despite some weaker Chinese inflation data which ought perhaps to have lent it some support.

December’s official Consumer Price Index for December came in with an annualized rise of 1.9%. This was below both the 2.1% expected and November’s 2.2% print. It was also the lowest rate of expansion since June 2018 and should argue at least somewhat against any removal of economic stimulus on the part of the authorities in Beijng.

Factory gate prices capture the imagination of markets somewhat less, as they have a weaker link to monetary policy. Still, the Producer Price Index alkso missed forecasts, rising 0.9% for the smalles increase since mid-2016.

The Australian Dollar often finds itself cast as foreign exchange’s preferred Chinese economic proxy thanks to the vast, close trade links between the two countries. Of late that relationship has tended to hold good when Chinese data disappoint, as they quite often have, rather than when they meet forecasts.

Still, AUD/USD was already wilting before this release. It continued to do so as markets mulled the numbers.

On its daily chart the Australian Dollar has in recent days risen back above the downward channel against the US Dollar which marked trade for much of 2018. AUD/USD sunk almost inexorably through the year as US interest rates rose, while Australia’s key Official Cash Rate remained stuck at the 1.50% record low. That has been in place since August 2016.

However, hopes for US/China trade talks have seen overall global risk appetite revive this week, supporting the Aussie in myriad ways, not least via higher commodity prices.

Still, at some point interest rate differentials will return to the driving seat and here the Australian currency has a problem. Not only are rates historically low, but rate-futures markets suggest that they could yet go lower still.

At present the Reserve Bank of Australia believes that the next move, when it eventually comes, is more likely to be a rise.

Either this prognosis is wrong, or the market is.

Resources for Traders

Whether you’re new to trading or an old hand DailyFX has plenty of resources to help you. There’s our trading sentiment indicator which shows you live how IG clients are positioned right now. We also hold educational and analytical webinars and offer trading guides, with one specifically aimed at those new to foreign exchange markets. There’s also a Bitcoin guide. Be sure to make the most of them all. They were written by our seasoned trading experts and they’re all free.

--- Written by David Cottle, DailyFX Research

Follow David on Twitter @DavidCottleFX or use the Comments section below to get in touch!