Sterling, Brexit and US dollar:

- TV debate between May and Corbyn now looking very unlikely.

- Brexit vote on December 11 may be delayed.

- GBPUSD may find support if US non-farm payrolls miss.

Q4 Trading Forecasts including USD and GBP.

Brexit Latest

The proposed tv debate between UK PM Theresa May and leader of the opposition Jeremy Corbyn is looking dead in the water after ITV pulled out of hosting the debate, days after the BBC pulled its bid to air the event. The event that was expected to be aired live on Sunday December 9 was an opportunity for both May and Corbyn to put forward their views and plans on Brexit just two days before the vote in the House of Commons.

And this vote may now be in doubt after senior Conservative members want the vote postponed allowing more time to be dedicated to the contentious backstop proposal. PM May is expected to lose the vote heavily on Tuesday and a delay would also allow her more time to shore up votes. The chairmen of the influential Conservative group, the 1922 Committee, said that getting clarity about how the UK could remove the backstop was more important than the timing of the vote. PM May has said that the vote will go ahead as planned.

Related Brexit and Sterling Articles:

GBPUSD: Sterling Support Remains Fragile as Brexit Chaos Continues.

Brexit Latest: Sterling (GBP) Sinks as UK PM May Loses Control.

Brexit Impact on GBP: How the Pound Might Move After Parliamentary Vote

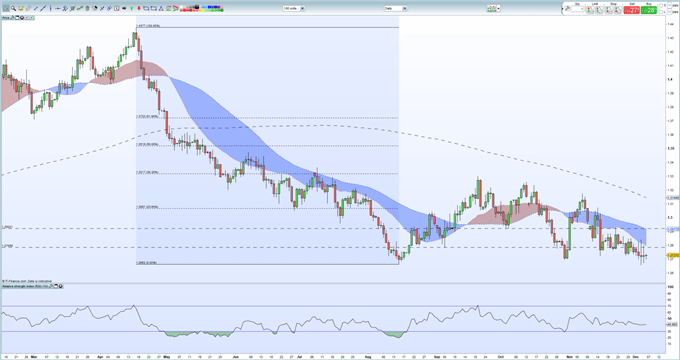

GBPUSD continues to trade sideways and remains vulnerable to further losses as the debate about the vote continues. The pair may find some solace from today’s US jobs report at 13:30 GMT where the headline figure is expected lower than last month. The US dollar has come under pressure in the last few days with the market now pairing back the timing and the amount of US interest rate hikes in 2019. Recent US Treasury yield curve inversion has prompted fears of a recession in mid-2020 in the US, tempering previous rate hike expectations.

DailyFX senior currency analyst Chris Vecchio will be covering the US Non-Farm Payroll Report live from 13:15 GMT.

GBPUSD Daily Price Chart (February – December 7, 2018)

Retail traders are 63.1% net-long GBPUSD, according to the latest IC Client Sentiment Data, a bearish contrarian indicator. However, recent changes in daily and weekly positions suggest the pair may move higher despite the fact that traders are net-long.

Traders may be interested in two of our trading guides – Traits of Successful Traders and Top Trading Lessons – while technical analysts are likely to be interested in our latest Elliott Wave Guide.

What is your view on GBPUSD – bullish or bearish?? You can let us know via the form at the end of this piece or you can contact the author at nicholas.cawley@ig.com or via Twitter @nickcawley1.