Gold Price, News and Analysis

- Recent rally looking vulnerable in the short-term.

- US dollar picks-up, weighing on the precious metal.

The DailyFX Q3 Gold Forecast is now available to help traders navigate the market.

Gold Needs to Stay Above $1,200/oz. to Rally Further

A pick-up in the US dollar, especially against the offshore Chinese Yuan, is weighing on gold and threatening to break its two-week uptrend. USDCNH is back around 6.8450, although it remains in a short-term downtrend, while the US dollar basket (DXY) trends higher in the short-term. DXY hit a one-month low of 94.00 on Tuesday and has crept back up to 94.25 but the move remains unconvincing and may yet re-test the recent low again.

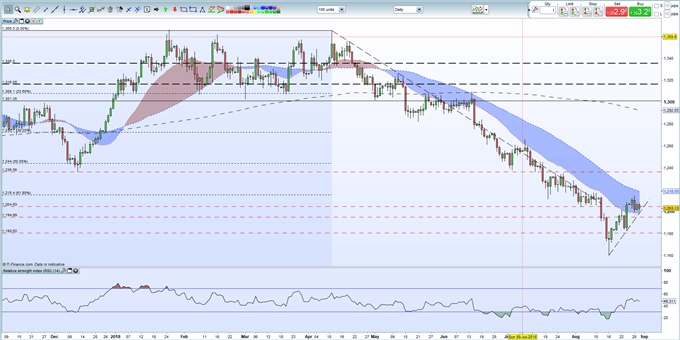

On the daily chart, Gold trades just above the uptrend line and the 50-day moving average at $1,198, while an old swing-low from March 2017 enters the picture at $1,194/oz. Below here support should be found from the Friday August 24 candle’s low at $1,184/oz. To break higher the precious metal will have to take out 61.8% Fibonacci resistance at $1,215/oz and the 20-day moving average at $1,218/oz.

Gold Bulls May Find Resistance

Gold Daily Price Chart (November 2017 – August 30, 2018)

The latest IG Retail Sentiment Indicator shows that traders remain 81.6% net-long of the precious metal, normallya bearish contrarian sentiment indicator. However recent changes in client sentiment suggest that prices may soon reverse higher.

Are you new to Gold trading or are you looking to improve your trading skill sets? We have recently produced an in-depth primer on How to Trade Gold: Top Gold Trading Strategies and Tips.

We are interested in your opinion and trading strategies for Gold, the US dollar and offshore Chinese Yuan – You canshare your thoughts, views or analysis with us using the comments section at the end of the article or you can contact the author via email at nicholas.cawley@ig.com or via Twitter @nickcawley1.

--- Written by Nick Cawley, Analyst