Bank of England and Sterling Prices, News and Analysis

- Sellers in control of Sterling as further rate hikes get priced out.

- Sterling looking at Brexit for the next move.

IG Client Sentiment shows retail are 69% net-long GBPUSD, a bearish contrarian indicator.

GBPUSD Will Struggle Now the BoE is in the Rearview Mirror

Sterlingis trading at the day’s low despite the Bank of England voting 9-0 for a 0.25% interest rate hike at today’s MPC meeting. The BoE said that further rate hikes would be gradual and limited and the market is now pricing in the next 0.25% hike in September 2019. The MPC also noted that UK growth over the forecast period would nudge slightly higher while inflation will remain above 2% before reaching target in 2020.

GBPUSD jumped then fell steadily to hit a fresh low for the day with traders now looking at Brexit as the primary driver of Sterling. Discussion between the UK and EU are ongoing but neither side is moving to allow a deal to be made. Sterling will follow these discussions – and the prevailing sentiment remains negative – now that monetary policy influence is pushed further into the future.

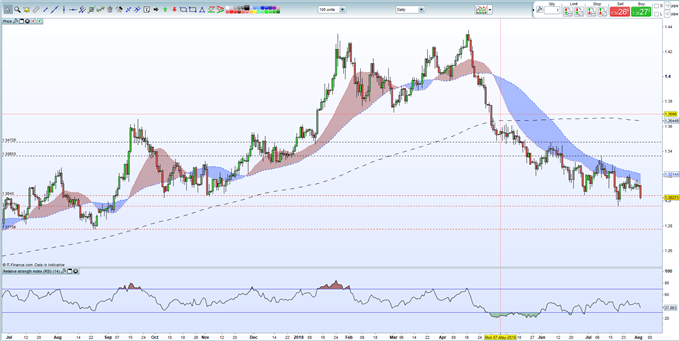

GBPUSD trades around 1.30250, just below support and just above the psychological 1.3000 level. A break and close below brings 1.29575 then 1.27738 (August 24 low) into play. On the upside 20- and 50-day resistance at 1.3137 and 1.3214 may prove difficult to breach in the short-term, especially against a robust US dollar.

We have recently released our Q3 Trading Forecasts for a wide range of Currencies and Commodities, including GBP and USD.

GBPUSD Daily Price Chart (July 2017 – August 2, 2018)

DailyFX has a vast amount of updated resources to help traders make more informed decisions. These include a fully updated Economic Calendar, and a raft of Educational and Trading Guides

--- Written by Nick Cawley, Analyst

To contact Nick, email him at nicholas.cawley@ig.com

Follow Nick on Twitter @nickcawley1