GBPUSD Analysis and News

Check out our new Fundamental and Technical Q3 forecast guide for GBPUSD

GBPUSD Trade Idea for the Week

UK Manufacturing Output Falls to 3-Month Low

UK Manufacturing PMI slipped to a 3-month low at 54 in July, also missing expectations of 54.2. This was also coupled with a downward revision to 54.3 from 54.4 for the prior months reading. GBP and the FTSE 100 saw a very muted reaction to the soft report, given that this is a final reading. IHS Markit stated that there were weaker increases in both output and new orders, while intermediate goods production fell for the first time in 2 years.

Bank of England Rate Outlook

The worse than expected Manufacturing PMI data will unlikely impact the Bank of England rate decision tomorrow, whereby the central bank is expected to raise the bank rate to 0.75%. As it stand’s market pricing is at 87% for rates to be hiked. However, the uncertainty lies within the path that monetary policy will take. As such, focus will be on the comments surrounding the near-term outlook for the BoE’s hiking cycle, particularly with UK government currently stepping up preparations in the event of a “no deal Brexit”.

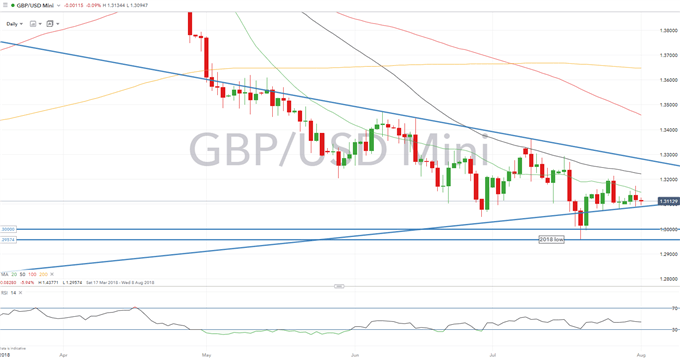

GBPUSD PRICE CHART: Daily-Time Frame ( March-August 2018)

What Does Positioning Tell us About the Direction in GBPUSD?

Data shows 66.8% of traders are net-long with the ratio of traders long to short at 2.01 to 1. In fact, traders have remained net-long since Apr 20 when GBPUSD traded near 1.40029; price has moved 6.4% lower since then. The number of traders net-long is 0.2% higher than yesterday and 0.3% higher from last week, while the number of traders net-short is 5.4% higher than yesterday and 12.1% lower from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-long suggests GBPUSD prices may continue to fall. Positioning is less net-long than yesterday but more net-long from last week. The combination of current sentiment and recent changes gives us a further mixed GBPUSD trading bias.

--- Written by Justin McQueen, Market Analyst

To contact Justin, email him at Justin.mcqueen@ig.com

Follow Justin on Twitter @JMcQueenFX