Receive the DailyFX US AM Digest in your inbox every day before US equity markets open - signup here

US Market Snapshot via IG: DJIA +0.35%, Nasdaq 100 +0.24%, S&P 500 +0.3%

Major Headlines

- Oil prices surge higher by over 2% following Trump's decision to exit Iran Nuclear Deal

- UK BRC sales sees sharpest drop in 22 years (-4.2% vs. Exp. -0.8%)

Crude Oil: WTI and Brent crude futures are charging higher this morning, with prices rising over 2%, the latter hitting $77 (highest level since Nov’2014) following President Trump’s widely expected decision to withdraw from the Iran Nuclear Deal and reimpose sanctions on Iran. As such, the rise in geopolitical tensions is likely to provide further upside risks to oil prices with Brent potentially making a move for $80/bbl (desired level among Saudi Arabian officials.)

USD: The USD rally has come to a halt today, retreating from highs of 93.42. However, the one way traffic of USD buying continues to remain firm in the near-term with a push higher in US bond yields likely to keep the greenback supported, while the short squeeze in large speculative USD bets likely to resume. December highs at 94.22 continues to remain insight for USD bulls, the risk driver for the USD will be tomorrows inflation report, which is expected to tick higher at 2.5% from 2.4%, as such this could keep the USD bid.

GBP: Uninspiring data from the UK overnight after the BRC reported that UK retailers suffered its sharpest drop for 22 years in April (-4.2% vs. Exp. -0.8%), albeit largely due to Easter effects. As such, the Pound is somewhat unfazed, with GBPUSD briefly reclaiming the 1.36 level, focus for GBP traders is the Bank of England Super Thursday, whereby GBP bulls will be hoping for a hawkish hold.

CAD: Unsurprisingly, the gains across the energy complex has pushed the Canadian Dollar higher. USDCAD seemingly topped out slightly, having failed to push through the 1.30 handle, little buying interest above 1.30 for now, the pair now back through 1.29. The recent fuelling of geopolitical instability in the Middle East does provide a bullish outlook for CAD buyers in the longer term amid upside risk to oil prices.

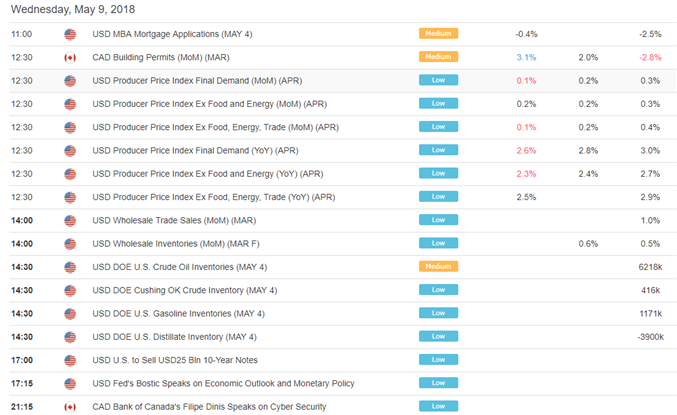

DailyFX Economic Calendar: Wednesday, May 9, 2018 – North American Releases

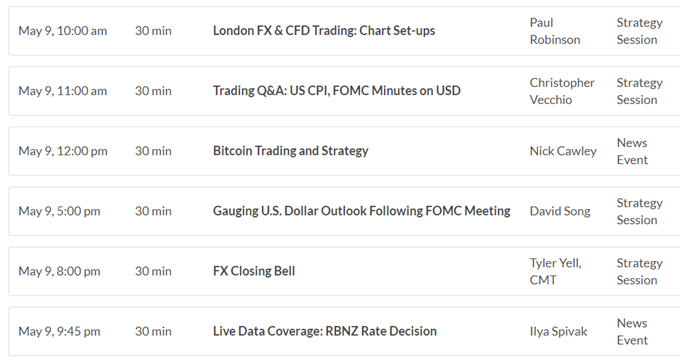

DailyFX Webinar Calendar: Wednesday, May 9, 2018

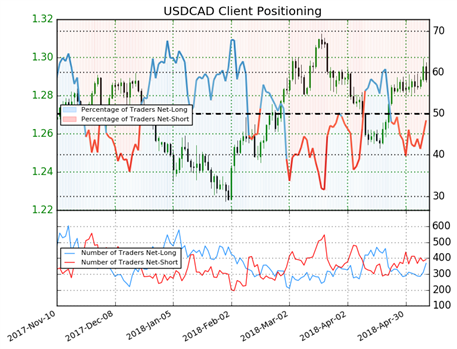

IG Client Sentiment Index: USDCAD Chart of the Day

USDCAD: Data shows 48.4% of traders are net-long with the ratio of traders short to long at 1.07 to 1. The number of traders net-long is 10.2% higher than yesterday and 17.3% higher from last week, while the number of traders net-short is 1.8% lower than yesterday and 1.0% lower from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-short suggests USDCAD prices may continue to rise. Yet traders are less net-short than yesterday and compared with last week. Recent changes in sentiment warn that the current USDCAD price trend may soon reverse lower despite the fact traders remain net-short.

Five Things Traders are Reading

- “US Dollar Rally Stalls but Uptrend to Remain in Place” by Christopher Vecchio, Senior Currency Strategist

- “EUR, GBP and Gold All Punished by Strong USD” by Martin Essex, MSTA, Analyst and Editor

- “Technical Outlook – Is USD a Short? Euro Cross-rate Appeal” (Video) by Paul Robinson, Market Analyst

- “Bullish CAD Outlook Over Long Term Amid Rising Oil Prices; However, NAFTA Presents Biggest Risk” by Justin McQueen, Market Analyst

- “Crude Oil Prices Hit Resistance, Next Move May Be Lower” by Martin Essex, MSTA, Analyst and Editor

The DailyFX US AM Digest is published every day before the US cash equity open - you can SIGNUP HERE to receive this report in your inbox every day.

The DailyFX Asia AM Digest is published every day before the Tokyo cash equity open - you can SIGNUP HERE to receive that report in your inbox every day.

If you're interested in receiving both reports each day, you can SIGNUP HERE.

--- Written by Justin McQueen, Market Analyst

To contact Justin, email him at Justin.mcqueen@ig.com Follow Justin on Twitter @JMcQueenFX