Ripple (XRP) News and Talking Points

- Chart support looks weak, highlighting market fragility.

- Will the SEC decide that XRP is a non-compliant security.

Ripple Looks Weak With Potential For Further Losses

The recent talk concerning whether or not Ripple is a security or not is starting to hit the token and pushing it towards important support levels. And with clients heavily long of XRP, a sharp sell-off may accelerate further as sellers seek bids.

Last month, the former chairman of the CFTC, Gary Gensler, opined that both Ether (ETH) and Ripple may be classified as a security and that regulators need to bring some clarity to the market, causing both tokens to move lower. And this week, the SEC is meant to be discussing the matter with the market worried that if XRP and ETH are classified as securities, that the value of the tokens will fall sharply. If a token is classified as a security then most, if not all, unregulated exchanges would refuse to or stop trading that token as it would bring regulatory scrutiny and oversight with it. It is worth noting that last month stories circulated that Ripple had offered monies and token loans to American crypto-exchanges to get the token listed, but to no avail.

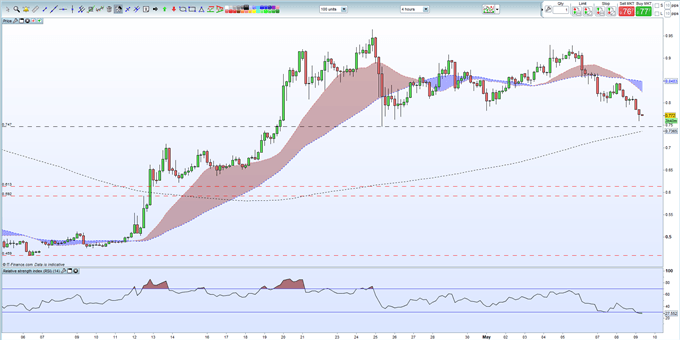

On the charts, XRP is heading towards the April 25 swing low at just under $0.75 which guards the 00-day moving average at $0.736. A break lower would leave the token vulnerable to further losses with a gap on the charts either side of $0.60 the next level of note. We continue to warn that traders are extremely long of Ripple and that if a run occurs on the token that support levels make become invalid.

We discuss a range of cryptocurrency charts and price set-ups at our Weekly Cryptocurrency Webinar today at 12:00.

Ripple (XRP) Four Hour Price Chart in US Dollars (April 5 – May 9, 2018)

Cryptocurrency Trader Resources

If you are interested in trading Bitcoin, Bitcoin Cash or Ether, Litecoin or Ripple check out our Introduction to Bitcoin Trading Guide.

What’s your opinion on Ripple – short-term pullback or bearish correction? Share your thoughts and ideas with us using the comments section at the end of the article or you can contact me on Twitter @nickcawley1 or via email at nicholas.cawley@ig.com.

--- Written by Nick Cawley, Analyst.