Litecoin Price (LTC) News and Talking Points

- Litecoin (LTC) hard fork and a new Litecoin Cash (LCC) token.

- Litecoin (LTC) needs to hold above chart support at $211 to push further ahead.

Litecoin Hard Fork But Litecoin Cash Not Related

The much talked about Litecoin hard fork occurred on Sunday at block 1,371,111 producing a new digital token, Litecoin Cash. Holders of Litecoin (LTC) were credited with the new token at a ratio of 1 original LTC: 10 new LCC. The price of the new token was around $2.70 at the time of writing, on just the YoBit exchange, a cryptocurrency marketplace founded in Russia that has produced a few, negative, headlines in the past.

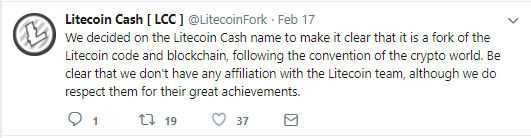

And to make things slightly more interesting, the new Litecoin Cash has nothing to do with the Litecoin project. In the last couple of weeks, Litecoin founder Charlie Lee tweeted that the hard fork had nothing to do with his company and that the fork was a scam. Now, according to a tweet from Litecoin Cash over the weekend, the coin has no affiliation with Litecoin, apart from the naming convention.

We covered a range of cryptocurrency charts at Wednesday's Weekly Cryptocurrency Webinar and came away with positive set-ups across a range of digital coins including Litecoin (LTC).

Litecoin (LTC) Needs to Hold Above Chart Support

A look at the latest LTC chart shows the coin still trading above strong support at $211 but with five lower highs, at the time of writing, this level may be tested again in the short-term. The stochastic indicator at the bottom of the chart is also showing LTC as strongly overbought and just starting to point lower. The fact that each LTC holders has received 10 LCC may underpin the price a touch – currently worth a nominal $27 per LTC – but it should be noted that at the moment just the one exchange has taken up the new coin and holders of LTC with other exchanges will have to wait to see if the new coin is taken up or use YoBit to gain access to the new tokens.

Litecoin Price Chart Daily Time Frame (September 1, 2017 – February 19, 2018)

Retail Traders Still Long Litecoin But Outlook Mixed

IG Client Sentiment data show 87.4% of traders are net-long with the ratio of traders long to short at 6.97 to 1. In fact, traders have remained net-long since Dec 25 when Litecoin traded near 253.95; price has moved 13.3% lower since then. The number of traders net-long is 7.1% higher than yesterday and 9.7% higher from last week, while the number of traders net-short is 0.8% lower than yesterday and 28.0% higher from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-long suggests Litecoin prices may continue to fall. Positioning is more net-long than yesterday but less net-long from last week. The combination of current sentiment and recent changes gives us a further mixed Litecoin trading bias.

Cryptocurrency Trader Resources – Free Practice Trading Accounts, Guides, Sentiment Indicators and Webinars

If you are interested in trading Bitcoin, Bitcoin Cash or Ethereum we can offer you a wide range of free resources to help you. We have an Introduction to Bitcoin Trading Guide. In addition we run a Weekly Bitcoin Webinar and have an IG Bitcoin Sentiment Indicator to help you gauge the market and make more informed trading decisions.

What’s your opinion on Litecoin and the latest hard fork? Share your thoughts with us using the comments section at the end of the article or you can contact the author via email at Nicholas.cawley@ig.com or via Twitter @nickcawley1.

--- Written by Nick Cawley, Analyst.