Receive the DailyFX US AM Digest in your inbox every day before US equity markets open - signup here

Volatility hit equity, bond, and FX markets this morning after the January US CPI report showed faster than anticipated price pressures in the world’s largest economy. And while the data won’t necessarily provoke a faster Fed rate hike timeline, rising price pressures mean the Federal Reserve will be less inclined to speak up during episodes of financial market volatility; as Senior Currency Strategist Christopher Vecchio, CFA says, we’re in the midst of a regime change.

Without the supportive backdrop of the past several years, equity investors are proving nervous. Accordingly, with the S&P 500 dropping around 30 handles after the CPI release, the Japanese Yen – as the prototypical safe haven – has gained ground across the board, particularly against the higher yielding commodity currency bloc.

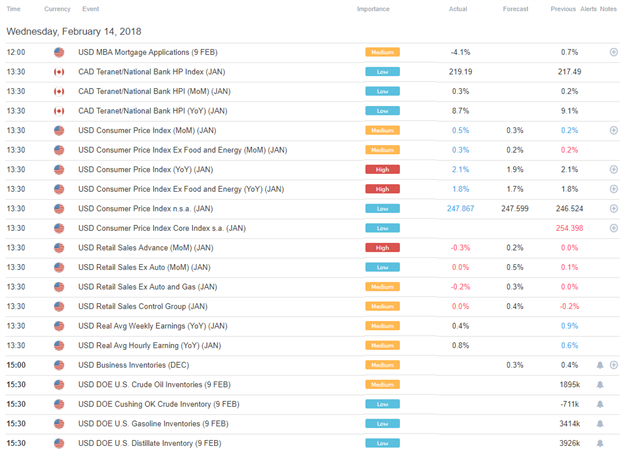

DailyFX Economic Calendar: Wednesday, February 14, 2018 – North American Releases

The combination of higher inflation and weaker retail sales has thrown USD-based assets for a loop, with the US Dollar, US Treasuries, and US equities trading lower in unison. The Atlanta Fed GDPNow Q1’18 growth tracker is likely to show a moderate revision lower as a result when it is released later on today. See the full market alert for more information on this morning’s US economic data. Later today, as is typical on Wednesdays, weekly energy inventory data is due out.

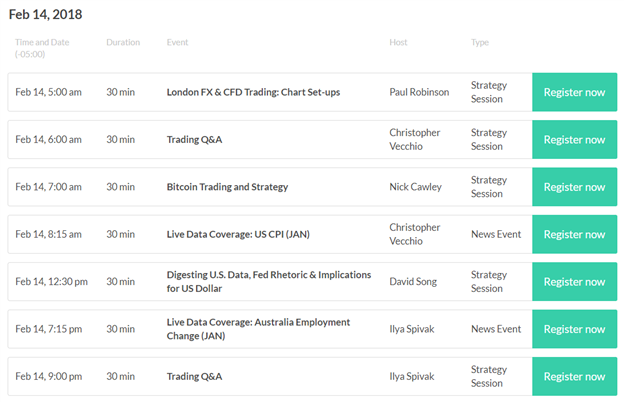

DailyFX Webinar Calendar: Wednesday, February 14, 2018

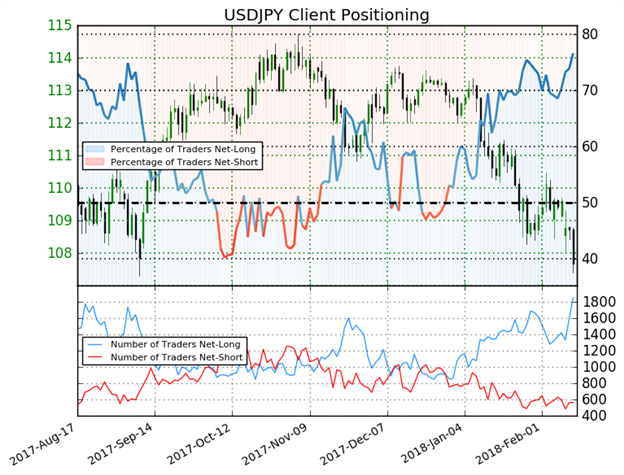

IG Client Sentiment Index Chart of the Day: USDJPY

Learn more about the IG Client Sentiment Index on the DailyFX Sentiment page

USDJPY: Retail trader data shows 76.6% of traders are net-long with the ratio of traders long to short at 3.28 to 1. In fact, traders have remained net-long since Dec 29 when USDJPY traded near 113.244; price has moved 4.9% lower since then. The number of traders net-long is 20.7% higher than yesterday and 41.1% higher from last week, while the number of traders net-short is 6.5% lower than yesterday and 15.3% lower from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-long suggests USDJPY prices may continue to fall. Traders are further net-long than yesterday and last week, and the combination of current sentiment and recent changes gives us a stronger USDJPY-bearish contrarian trading bias.

Five Things Traders are Reading

- “Dollar Rises as Broad-Based Inflation Offsets Falling Retail Sales” by Dylan Jusino, DailyFX Research

- “Trading Outlook for Yen, NZD-crosses, Crude Oil & More” by Paul Robinson, Market Analyst

- “Bitcoin Price Chart Signals Higher Prices But at a Slower Pace” by Nick Cawley, Analyst

- “GBP JPY Weakness Nears Important Technical Support” by Nick Cawley, Analyst

- “Gold and Crude Oil Prices May Fall if US CPI Tops Expectations” by Ilya Spivak, Senior Currency Strategist

The DailyFX US AM Digest is published every day before the US cash equity open - you can SIGNUP HERE to receive this report in your inbox every day.

The DailyFX Asia AM Digest is published every day before the Tokyo cash equity open - you can SIGNUP HERE to receive that report in your inbox every day.

If you're interested in receiving both reports each day, you can SIGNUP HERE.