To get the Asia AM Digest every day, SIGN UP HERE

The New Zealand Dollar became Wednesday’s worst performing major after the RBNZ monetary policy announcement. The central bank appeared to be in no rush to raise the official cash rate soon, making it clearer that the Kiwi could soon lose its yield advantage over its US counterpart.

Speaking of the US Dollar, it rose to about a 3-week high as Fed’s policymakers Robert Kaplan and William Dudley commented on Monday’s aggressive risk aversion. Both of them had no consequential things to say about it affecting the current economic outlook. Like Bullard noted yesterday, they did not seem so surprised.

Meanwhile, the anti-risk Japanese Yen was among the best performers as volatile stocks on Wall Street swung and ended the day lower due to a last minute selloff. This seemed to occur around a 10-year US government bond auction which saw demand drop as yields rose towards a 4-year high. The sentiment-linked Australian Dollar also declined.

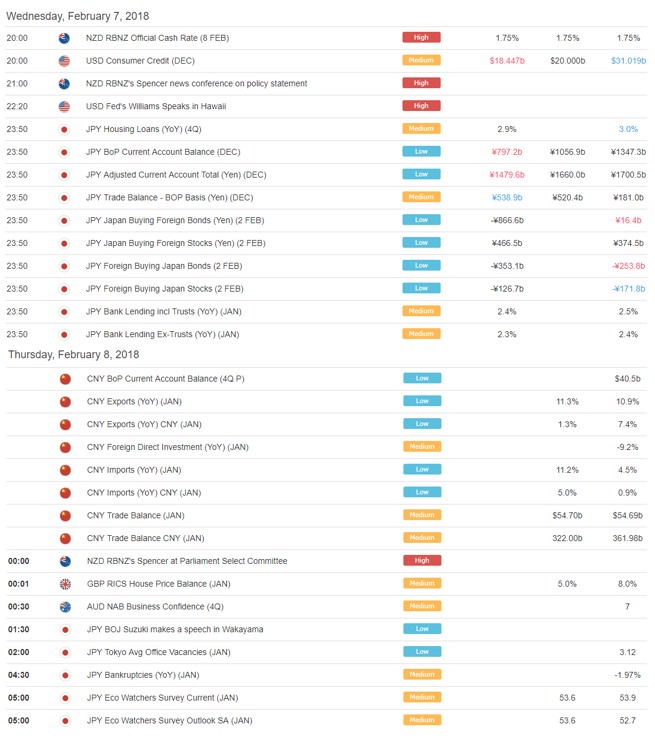

DailyFX Economic Calendar: Asia Pacific (all times in GMT)

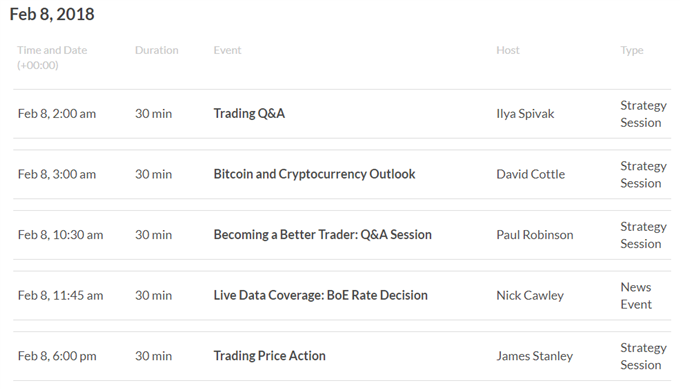

DailyFX Webinar Calendar – CLICK HERE to register (all times in GMT)

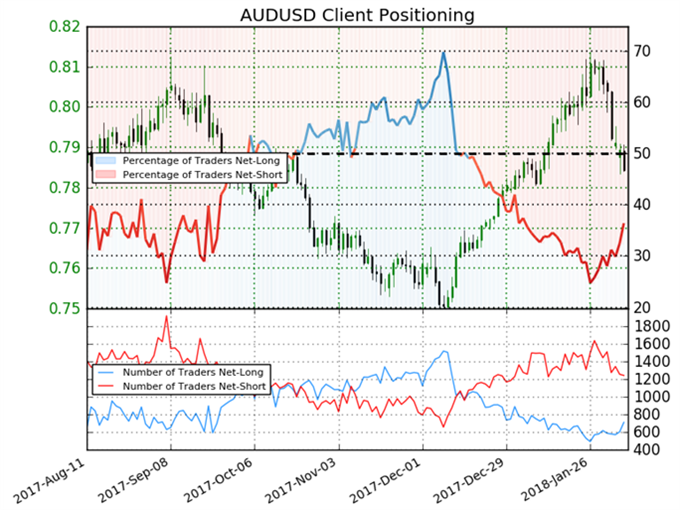

IG Client Sentiment Index Chart of the Day: AUD/USD

CLICK HERE to learn more about the IG Client Sentiment Index

Retail trader data shows 36.4% of AUD/USD traders are net-long with the ratio of traders short to long at 1.75 to 1. In fact, traders have remained net-short since Dec 19 when AUD/USD traded near 0.75283; price has moved 4.2% higher since then. The percentage of traders net-long is now its highest since Jan 22 when AUD/USD traded near 0.80074. The number of traders net-long is 24.3% higher than yesterday and 20.7% higher from last week, while the number of traders net-short is 7.5% lower than yesterday and 26.5% lower from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-short suggests AUD/USD prices may continue to rise. Yet traders are less net-short than yesterday and compared with last week. Recent changes in sentiment warn that the current AUD/USD price trend may soon reverse lower despite the fact traders remain net-short.

Five Things Traders are Reading:

- NZD/USD Drops After RBNZ Holds Rates with Tepid Inflation Outlook by John Kicklighter, Chief Currency Strategist

- Webinar: Cryptocurrencies Rally on Positive US Regulatory Comments by Nick Cawley, Analyst

- European Bonds Benefit From German Coalition Deal by Martin Essex, MSTA, Analyst and Editor

- EUR/USD Price Chart Shows Bullish Trend Remains by Nick Cawley, Analyst

- Crude Oil and Natural Gas Approach Longer Term Pivot Levels by Jeremy Wagner, CEWA-M, Head Forex Trading Instructor

To get the Asia AM Digest every day, sign up here

To get the US AM Digest every day, sign up here

To get both reports daily, sign up here