To get the Asia AM Digest every day, SIGN UP HERE

The US Dollar soared against its major counterparts on Friday, buoyed by better-than-expected US labor-market data. The sentiment-linked Australian, Canadian and New Zealand Dollars tracked a steep drop in stock prices.

Risk aversion brought US shares their largest one-day drop in 16 months. The newswires cited fears of a steeper Fed rate hike cycle as the catalyst for the selloff. The perennially anti-risk Japanese Yen and Swiss Franc duly advanced.

The Euro rallied as German Chancellor Angela Merkel prepared for the final round of coalition talks with the rival SPD party in an effort to secure a grand coalition government for the Eurozone’s largest economy. The single currency scored gains versus all of the majors except the greenback.

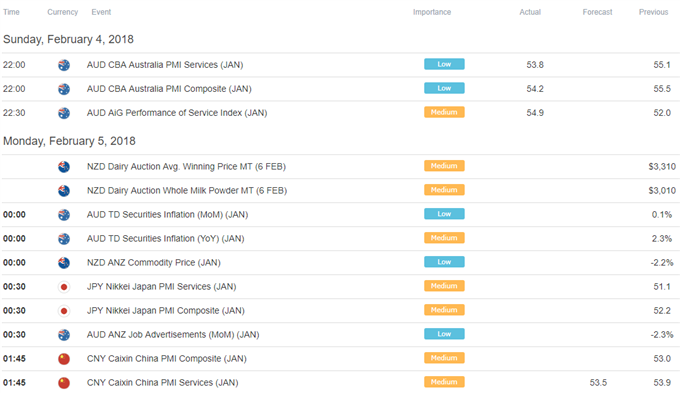

DailyFX Economic Calendar: Asia Pacific (all times in GMT)

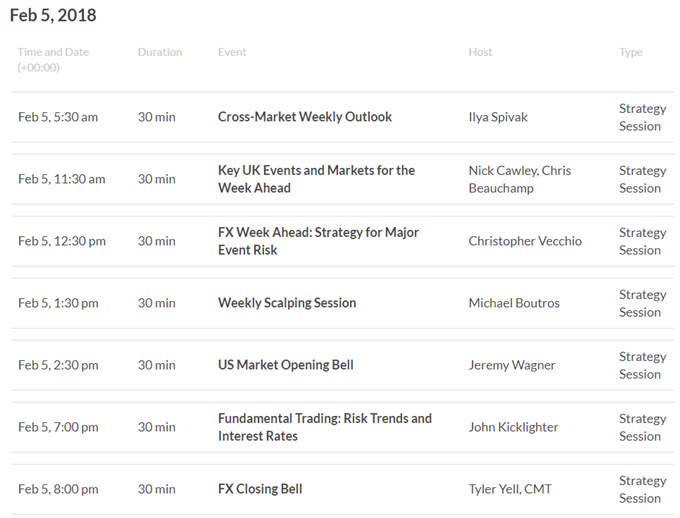

DailyFX Webinar Calendar – CLICK HERE to register (all times in GMT)

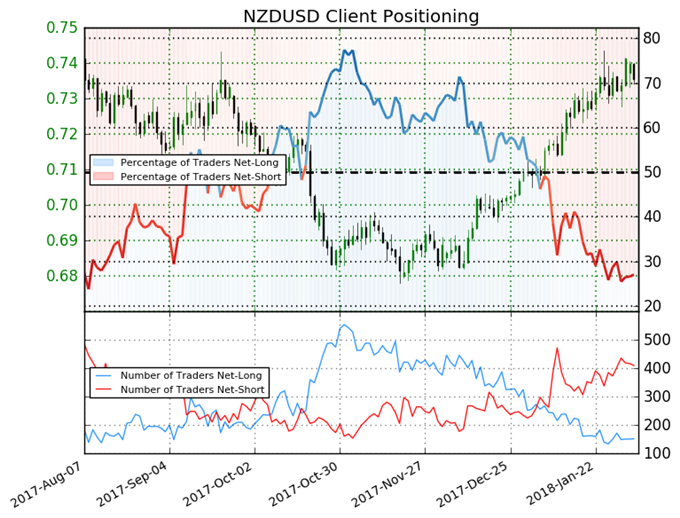

IG Client Sentiment Index Chart of the Day: NZD/USD

CLICK HERE to learn more about the IG Client Sentiment Index

Retail trader data shows 27.0% of traders are net-long NZD/USD, with the ratio of traders short to long at 2.7 to 1. In fact, traders have remained net-short since Jan 05 when NZD/USD traded near 0.70972; price has moved 3.6% higher since then. The number of traders net-long is 1.9% lower than yesterday and 16.9% higher from last week, while the number of traders net-short is 3.1% lower than yesterday and 7.9% higher from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-short suggests NZD/USD prices may continue to rise. Yet traders are less net-short than yesterday and compared with last week. Recent changes in sentiment warn that the current NZD/USD price trend may soon reverse lower despite the fact traders remain net-short.

Five Things Traders are Reading:

- Weekly Trading Forecast: All Eyes on RBA, RBNZ and BOE Rate Calls by DailyFX Research Team

- What Does the Beginning of a Global Market Collapse Look Like? by John Kicklighter, Chief Currency Strategist

- US Dollar Gains as January NFP Shows Faster Jobs and Wage Growth by Christopher Vecchio, CFA, Sr. Currency Strategist

- EUR/USD Weekly Technical Outlook: Euro Fending Off USD Buyers (For Now) by Paul Robinson, Market Analyst

- Australian Dollar Can’t Hope For Much From RBA Policy Call by David Cottle, Analyst

To get the Asia AM Digest every day, sign up here

To get the US AM Digest every day, sign up here

To get both reports daily, sign up here