Receive the DailyFX US AM Digest in your inbox every day before US equity markets open - signup here

Despite a strong performance to close out yesterday, the US Dollar finds itself trading lower once again on Thursday. The greenback has been unable to find its footing this week even as the US Treasury 10-year yield increased to its highest level since March 14, 2017. Traders remain focused on the political risk potential around the US government shutdown, set to take effect at the end of the day tomorrow if no continuing resolution or full budget deal is reached. Elsewhere, after several days of steep losses, the cryptocurrency market is rebounding sharply, with Bitcoin (BTCUSD) and Etherium (ETHUSD) up over +10% and Ripple (XRPUSD) up over +30% on the day.

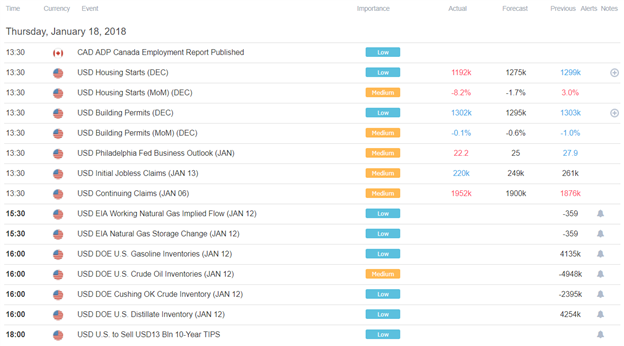

DailyFX Economic Calendar: Thursday, January 18, 2018 – North American Releases

The bulk of the North American economic data is out of the way for Thursday, with the US housing data for December largely disappointing expectations. The remainder of the day, energy inventories out of the United States could prove market moving for crude oil and thus CAD-crosses. With negotiations over the US federal government shutdown ongoing and the economic calendar expected to be lighter for the remainder of the week, traders would be wise to train their attention on the news wire for market moving updates.

DailyFX Webinar Calendar: Friday, January 19, 2018

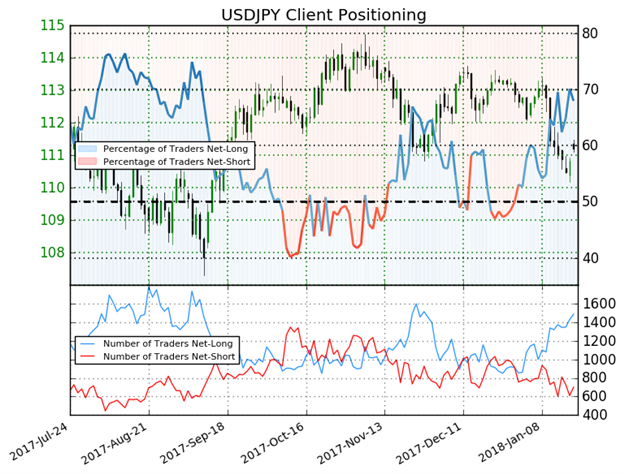

IG Client Sentiment Index Chart of the Day: USDJPY

Learn more about the IG Client Sentiment Index on the DailyFX Sentiment page

USDJPY: Retail trader data shows 68.0% of traders are net-long with the ratio of traders long to short at 2.12 to 1. In fact, traders have remained net-long since Dec 29 when USDJPY traded near 113.208; price has moved 1.8% lower since then. The number of traders net-long is 7.8% higher than yesterday and 15.3% higher from last week, while the number of traders net-short is 9.1% lower than yesterday and 7.0% lower from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-long suggests USDJPY prices may continue to fall. Traders are further net-long than yesterday and last week, and the combination of current sentiment and recent changes gives us a stronger USDJPY-bearish contrarian trading bias.

Five Things Traders are Reading

- “It’s Still Too Early to Call a Bottom in the US Dollar” by Christopher Vecchio, CFA, Senior Currency Strategist

- “Ripple Price Action Respects Technical Levels, Will it Hodl?” by Nick Cawley, Analyst

- “Bitcoin & Major Cryptocurrency Charts – Reversals May Be Short-lived” by Paul Robinson, Market Analyst

- “EUR/JPY Technical Analysis: Trend-Line Bounce into Resistance Zone” by James Stanley, Currency Strategist

- “GBPUSD to Remain Firm as Brexit Bill Heads for House of Lords” by Martin Essex, MSTA, Analyst and Editor

The DailyFX US AM Digest is published every day before the US cash equity open - you can SIGNUP HERE to receive this report in your inbox every day.

The DailyFX Asia AM Digest is published every day before the Tokyo cash equity open - you can SIGNUP HERE to receive that report in your inbox every day.

If you're interested in receiving both reports each day, you can SIGNUP HERE.