Receive the DailyFX US AM Digest in your inbox every day before US equity markets open - signup here

The turn through the ides of January has brought little positivity to the US Dollar, which finds itself trading at its lowest level in over three years (via the DXY Index). However, with US financial markets closed for the Martin Luther King Jr. holiday, much of the movement in USD-pairs was a result of moves abroad. Despite ongoing strength in global equity markets, the Japanese Yen continues to post gains versus the US Dollar after the BOJ made its tapering announcement earlier this month. Elsewhere, the British Pound and the Euro are eying December inflation data due out on Tuesday and Wednesday, respectively.

DailyFX Economic Calendar: Monday, January 15, 2018 – North American Releases

The economic calendar was light on Monday, no surprise given the US federal holiday. The only piece of data released, December Canadian Existing Home Sales, came in above expectations, providing more fuel for a resurgent Canadian Dollar. The Bank of Canada meets this Wednesday and is widely expected to hike rates 25-bps to 1.25%.

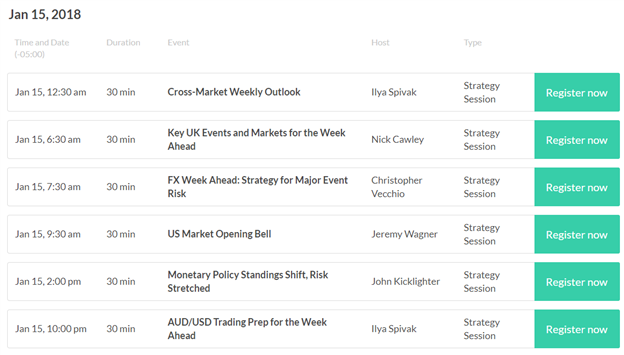

DailyFX Webinar Calendar: Monday, January 15, 2018

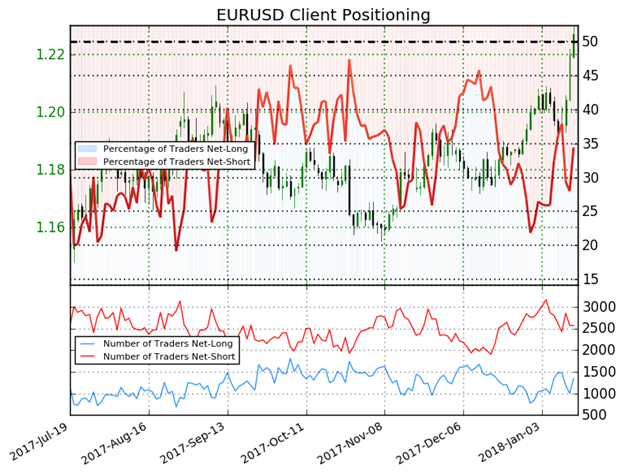

IG Client Sentiment Index Chart of the Day: EURUSD

Learn more about the IG Client Sentiment Index on the DailyFX Sentiment page

EURUSD: Retail trader data shows 34.4% of traders are net-long with the ratio of traders short to long at 1.91 to 1. The number of traders net-long is 12.6% higher than yesterday and 9.7% higher from last week, while the number of traders net-short is 6.5% lower than yesterday and 18.7% lower from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-short suggests EURUSD prices may continue to rise. Yet traders are less net-short than yesterday and compared with last week. Recent changes in sentiment warn that the current EURUSD price trend may soon reverse lower despite the fact traders remain net-short.

Five Things Traders are Reading

- “FX Markets Look to UK & EZ CPI, BOC Rate Decision, Aussie Employment” by Christopher Vecchio, CFA, Senior Currency Strategist

- “Gold & Silver Technical Outlook: Can They Break Resistance?” by Paul Robinson, Market Analyst

- “GBP/USD Pushing Higher But May Need to Consolidate” by Nick Cawley, Analyst

- “US Dollar Index (DXY) Forecast: Pessimism Holds on Move to 2009 Extreme” by Tyler Yell, CMT, Forex Trading Instructor

- “Euro Turns to 2017’s Final CPI Figures After ECB Minutes Hint at Faster Exit” by Christopher Vecchio, CFA, Senior Currency Strategist

The DailyFX US AM Digest is published every day before the US cash equity open - you can SIGNUP HERE to receive this report in your inbox every day.

The DailyFX Asia AM Digest is published every day before the Tokyo cash equity open - you can SIGNUP HERE to receive that report in your inbox every day.

If you're interested in receiving both reports each day, you can SIGNUP HERE.