Sterling Talking Points

- UK Industrial production is expected to have shown an uptick in November.

- GBPUSD continues to trade sideways but the pair remain close to Brexit day levels.

Check out our new Trading Guides: they’re free and have been updated for the first quarter of 2018

UK Data May Push GBPUSD Higher

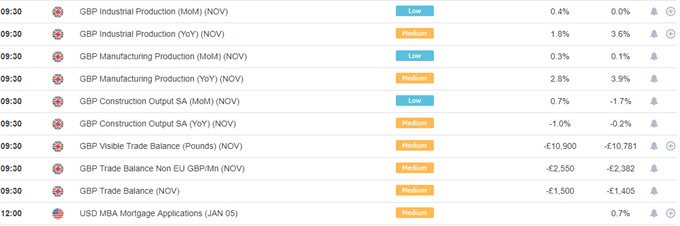

UK industrial, manufacturing and construction data are released Wednesday and may help GBPUSD break out of its recent tight trading range. On a monthly basis all three are expected to move higher while on a year-on-year basis all three are expected to come in below October’s numbers. A look at the Markit PMI release for November showed manufacturing hitting a 51-month high, although this subsequently slipped back in December. A better-than-expected monthly release will likely push GBPUSD back to the upper part of the trading band.

UK Economic Data to be Released on January 10, 2018

Sterling Stuck in a Rut, For Now

A look at the daily GBPUSD chart shows the pair trading with a bullish backdrop and looking for a reason to push further ahead. The medium-term uptrend remains intact while the pair trade above the 20-, 50- and 100-day emas, a positive set up. The September 21, 2017 high at 1.36570 remains close which, if broken, would take the pair back to levels last seen on Brexit day, June 23, 2016.

GBPUSD Price Chart Weekly Timeframe (May 2016 – January 9, 2018)

GBPUSD Client Positioning Data Show Conflicting Signals

IG Client Sentiment data shows38.2% of traders are net-long GBPUSD with the ratio of traders short to long at 1.62 to 1. In fact, traders have remained net-short since Dec 28 when GBPUSD traded near 1.33732; price has moved 1.1% higher since then. The number of traders net-long is 6.2% higher than yesterday and 5.7% higher from last week, while the number of traders net-short is 2.6% higher than yesterday and 16.8% higher from last week. We typically take a contrarian view to crowd sentiment, and the fact traders are net-short suggests GBPUSD prices may continue to rise. Positioning is less net-short than yesterday but more net-short from last week. The combination of current sentiment and recent changes gives us a further mixed GBPUSD trading bias.

The Traits of Successful Traders and how to find the Number One Mistake Traders Make are just two of the topics covered in our Free Trading Guides.

--- Written by Nick Cawley, Analyst

To contact Nick, email him at nicholas.cawley@ig.com

Follow Nick on Twitter @nickcawley1