Receive the DailyFX US AM Digest in your inbox every day before US equity markets open - signup here

The first trading day of 2018 (though not the first ‘full’ trading day, given that Japan was on holiday) is off to a poor start for the US Dollar. While there are no new factors influencing the greenback per se, it would appear that the negative momentum that marked the end of December 2017 is finding follow through at the start of the New Year. Despite the fact that US President Trump signed the tax reform bill into law before Christmas, rates markets are not pricing in a material bump to US growth or inflation expectations. Accordingly, early signs indicate that traders feel the Federal Reserve may be too optimistic in their forecast for three hikes in 2018.

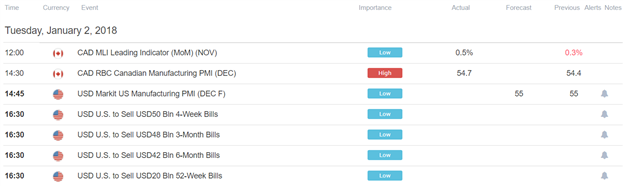

DailyFX Economic Calendar: Tuesday, January 2, 2018 – North American Releases

The North American economic calendar is fairly quiet as trading resumes in the New Year, with the only ‘high’ importance event already in the rearview mirror (December Canadian Manufacturing PMI beat at 54.7 from 54.4). The rest of the day, bill sales are in sight at the US Treasury. It is worth noting that US government debt sales are scheduled to be at their highest rate in eight years, with net issuance due in at $1.3 trillion. A higher supply of US debt could mean there is a natural tendency for rates to be pointed higher (given the inverse relationship between price and rates).

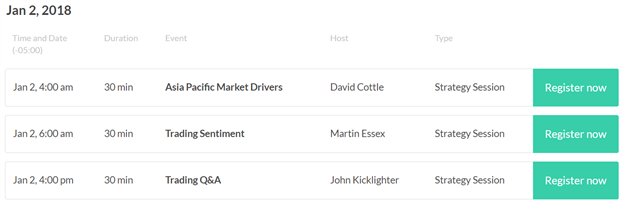

DailyFX Webinar Calendar: Tuesday, January 2, 2018

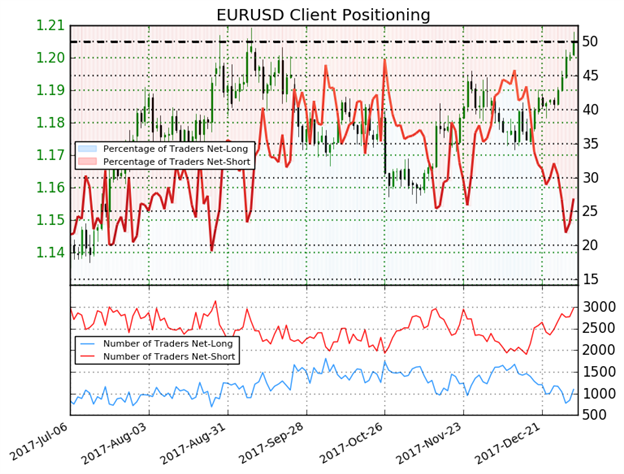

IG Client Sentiment Index Chart of the Day: EURUSD

Learn more about the IG Client Sentiment Index on the DailyFX Sentiment page

EURUSD: Retail trader data shows 26.9% of traders are net-long with the ratio of traders short to long at 2.72 to 1. The number of traders net-long is 38.4% higher than yesterday and 3.8% lower from last week, while the number of traders net-short is 7.4% higher than yesterday and 19.1% higher from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-short suggests EURUSD prices may continue to rise. Positioning is less net-short than yesterday but more net-short from last week. The combination of current sentiment and recent changes gives us a further mixed EURUSD trading bias.

Five Things Traders are Reading

- “FX Markets Start the New Year with Euro-Zone CPI, US NFP in Sight” by Christopher Vecchio, CFA, Senior Currency Strategist

- “Volatility Won’t Stay Low Forever: Political Risks Set to Rise in 2018” by Christopher Vecchio, CFA, Senior Currency Strategist

- “GBP Falls as UK Manufacturing Misses Lofty Expectations” by Nick Cawley, Analyst

- “Will The Bank of England Offer a Bitcoin-Style Cryptocurrency?” by Nick Cawley, Analyst

- “DailyFX Q1 2018 Forecasts: USD, Oil and Equities” by the DailyFX Research Team

The DailyFX US AM Digest is published every day before the US cash equity open - you can SIGNUP HERE to receive this report in your inbox every day.

The DailyFX Asia AM Digest is published every day before the Tokyo cash equity open - you can SIGNUP HERE to receive that report in your inbox every day.

If you're interested in receiving both reports each day, you can SIGNUP HERE.