Talking Points

- The May 18 GBPUSD high of 1.30480 looks increasingly likely to hold despite ‘soft Brexit’ talk.

- BoE chief economist Andy Haldane speaks Tuesday – will he repeat his recent hawkish views?

Looking for trading ideas? - Get your free DailyFX Third-Quarter Trading Forecast and Trading Guide here.

GBPUSD continues to struggle to gain any upside traction, with this year’s high of just under 1.30500 continuing to cap any upside move. A look at the charts shows the pair nearing the 20-day and 50-day moving average, with any break lower likely to weigh on sterling. In Sterling’s defense the Stochastic indicator shows the market is currently oversold, which may limit any further downside in the short-term.

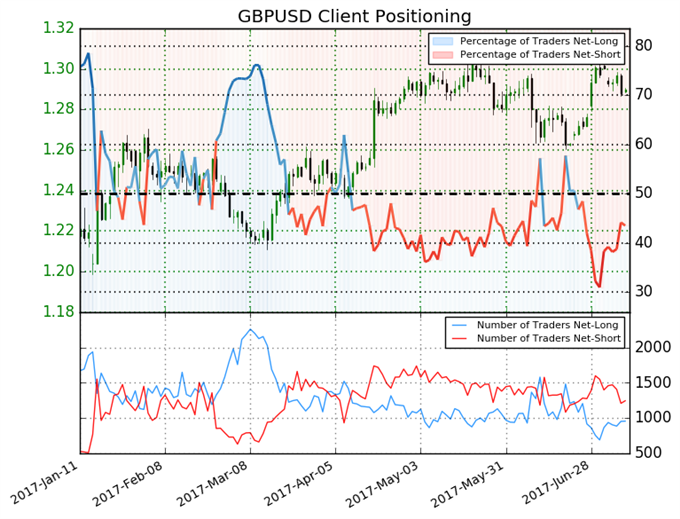

Chart: GBPUSD Daily Timeframe (March 15 – July 10, 2017)

Away from the technical set-up, GBP may get some support from weekend talk that UK PM Theresa May’s position is becoming more and more untenable and that various factions within the Conservative party are looking to force the PM to resign. While any political upheaval normally sinks the currency lower, the markets see a slightly ‘softer’ Brexit if PM May is not at the helm, a positive for Sterling in most people’s eyes.

The British Pound may also get a boost on Tuesday when Bank of England chief economist Andy Haldane speaks at 10:00 GMT. Although the text of the speech is not expected to be released, Haldane recently spoke out about raising UK interest rates, saying that beginning the process of withdrawing some of the incremental stimulus provided last August, “would be prudent moving into the second half of the year.”

And to further muddy the water, it looks as though retail investors are changing their stance on GBPUSD, according to the latest IG Retail Sentiment data. The numbers show that retail investors have been closing out their GBPUSD short positions in recent days, and while they still remain net short – normally a bullish signal – the shift in sentiment could see the pair move lower.

If you would like to get your free IG Client Sentiment trading guide, please click here.

--- Written by Nick Cawley, Analyst

To contact Nick, email him at nicholas.cawley@ig.com

Don't trade FX but want to learn more? Read the DailyFX Trading Guides