Talking Points

- UK economy continues to slow down heading into the third quarter.

- GBP/USD trades around 1.29000, heading for its third daily loss in a row.

The UK services sector slowed down in June – to 53.4 against expectations of 53.5 and May’s 53.8 – sending GBP/USD back below 1.29000, as the latest mini-rally in Sterling fizzles away.

Today’s figures confirm the slowdown seen in the economy after the UK manufacturing PMI fell to 54.3 in June 2017 from a downwardly revised 56.3 in May.

Chris Williamson, chief business economist at IHS Markit, wrote: “A slowing in services sector growth completes a triple-whammy of disappointing PMI survey readings. Although the three PMI surveys are running at levels that are historically consistent with GDP growing by around 0.4% in the second quarter, it’s clear that the economy heads into the third quarter losing momentum.”

GBP/USD continues to give back its recent gains that saw the pair trade back above 1.30000. A look at the stochastic indicator however sees the pair heading towards oversold territory, giving GBP a small support buffer.

Chart: GBPUSD Daily Timeframe (March 10 – July 5, 2017)

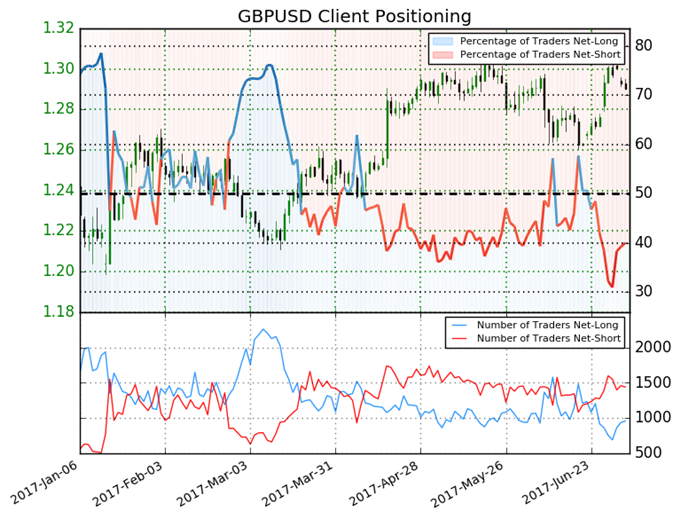

This slightly mixed outlook for Sterling is confirmed in the latest look at retail positioning. Retail trader data shows 40.0% of traders are net-long, with the ratio of traders short to long at 1.5 to 1. In fact, traders have remained net-short since Jun 23, when GBPUSD traded near 1.2718; the price has moved 1.5% higher since then. Positioning is less net-short than yesterday but more net-short from last week. The combination of current sentiment and recent changes gives us a further mixed GBPUSD trading bias.

For a comprehensive look at retail positioning across a wide range of assets, get a free copy of the IG Retail Sentiment Data Here.

And looking ahead, tonight’s FOMC minutes release may well weigh further on Sterling if Fed Chair Janet Yellen gives further insight into future US rate rises. And on Friday, July 7, a raft of UK domestic data, including industrial and manufacturing production, may well see Sterling weaken further.

--- Written by Nick Cawley, Analyst

To contact Nick, email him at nicholas.cawley@ig.com

Don't trade FX but want to learn more? Read the DailyFX Trading Guides