Talking Points

- Hawkish FOMC minutes will boost the USD but support remains for the single currency.

- Data points to strong Euro-Zone growth in Q2 2017

Looking for trading ideas? - Get your free DailyFX Third-Quarter Trading Forecast and Trading Guide here.

The latest FOMC minutes are released later Wednesday with investors parsing the release for any hints on further interest rate cuts or the timing of any balance sheet contraction. Either would give the USD a further boost, especially with short-term interest rates in the US nearing multi-year highs. The interest-rate sensitive 2-yeat US Treasury currently yields around 1.415%, around one basis point from levels last seen in late-2008.

For more on the FOMC meeting, possible outcomes and trading opportunities, watch senior currency strategist @CVecchioFX here

The EUR however is not without its strengths with the latest Markit Euro-Zone PMI reading for June beating forecasts – 56.3 vs. 55.7. According to the data provider, this indicates that the Euro-Zone economy grew at a robust rate of 0.7% in the second quarter of 2017.

A look at the pair currently shows the EUR under downward pressure although support nears. The first level of support comes in at the June 27 low of 1.11788, while the pair have not traded below 1.11000 since May 19. The stochastic indicator is also pointing towards the pair being oversold in the short-term as it nears the 20 level.

Chart: EURUSD Daily Timeframe (February 15 – July 5, 2017)

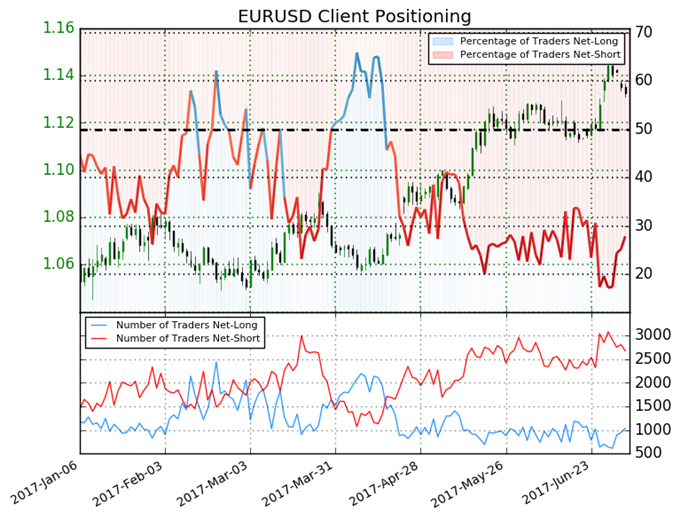

A further mixed-to-bullish sign for EURUSD comes from the IG Client Sentiment Indicator which shows that retail traders remain short of the pair by 71% to 29%.

Retail trader data shows 27.9% of traders are net-long with the ratio of traders short to long at 2.58 to 1. In fact, traders have remained net-short since Apr 18 when EURUSD traded near 1.0589; price has moved 6.9% higher since then. We typically take a contrarian view to crowd sentiment, and the fact traders are net-short suggests EURUSD prices may continue to rise. However, traders are less net-short than yesterday and compared with last week. Recent changes in sentiment warn that the current EURUSD price trend may soon reverse lower despite the fact traders remain net-short.

If you would like to get your free IG Client Sentiment trading guide, please click here.

--- Written by Nick Cawley, Analyst

To contact Nick, email him at nicholas.cawley@ig.com

Don't trade FX but want to learn more? Read the DailyFX Trading Guides