Talking Points

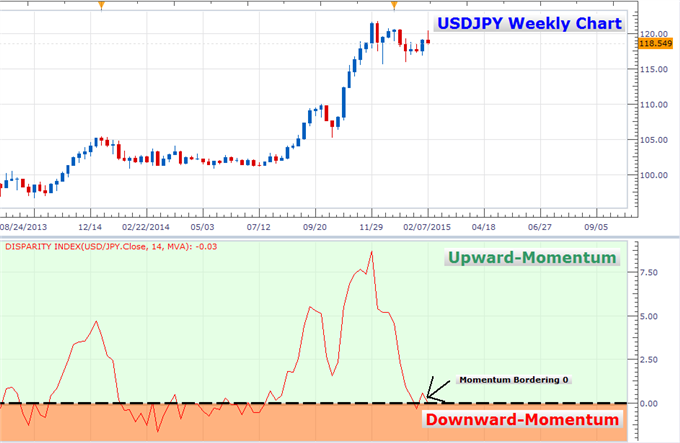

- USDJPYdecline since December 1st 2014 has been slowing

- The pair has been treading water whilethe Disparity Index Indicatorhas been hovering on the borderof negative territory

- Download the Disparity Index Indicator to gauge trend momentum on the Tradestation Marketscope 2.0 platform for free, here

The Dollar-Yen’s bullish run has been sidelined since December 1st 2014. The pair has been treading water while the Disparity Index Indicator has been hovering on the border of negative territory. The Disparity indicator shows upward or downward progress for a given pair. Today’s close for the USDJPY brought the indicator back to 0. The pair has now been hovering around the border for two weeks.

The pair’s pared momentum doesn’t necessarily mean that a reversal is at hand (this is a weekly chart, so timing needs to account for the periodicity at the very least). Similar circumstances occurred for the pair through the beginning of 2014. The pair consolidated in coordination with the indicator for six months before launching higher. Next week’s forecast for the USDJPY remains neutral according to Currency Analyst David Song. However, the release of Japan’s fourth quarter GDP this Sunday may destabilize the Yen and lead the Bank of Japan to change its tone on its persistent dovish policy.