EUR/USD Rate Talking Points

EUR/USD fails to extend the series of lower highs and lows carried over from last week as the European Central Bank (ECB) warns of a looming adjustment in the forward guidance for monetary policy, but the exchange rate may continue to give back the rebound from the yearly low (1.0806) as it continues to fall back from the 50-Day SMA (1.1145).

EUR/USD Eyes Yearly Low Even as ECB Warns of Interest Rate Adjustment

EUR/USD bounces back from a fresh weekly low (1.0897) as the account of the European Central Bank’s (ECB) March meeting reveals that “a large number of members held the view that the current high level of inflation and its persistence called for immediate further steps towards monetary policy normalisation.”

It seems as though the Governing Council is preparing to shift gears as “the three forward guidance conditions for an upward adjustment of the key ECB interest rates had either already been met or were very close to being met,” but the economic disruptions caused by the Russia-Ukraine war may force President Christine Lagarde and Co. to delay normalizing monetary policy as the central bank acknowledges that “the euro area could fall into technical recession in the summer quarters.”

As a result, the ECB may carry out a wait-and-see approach while it winds down the Asset Purchase Programme (APP) as “the calibration of net purchases for the third quarter will be data-dependent,” and the diverging paths between the Governing Council and Federal Reserve may continue to drag on EUR/USD as Chairman Jerome Powell and Co. plan to“begin reducing its holdings of Treasury securities and agency debt and agency mortgage-backed securities at a coming meeting.”

In turn, EUR/USD may continue to exhibit a bearish trend in 2022 as it remains under pressure after testing the 50-Day SMA (1.1145), and a further decline in the exchange rate may fuel the tilt in retail sentiment like the behavior seen earlier this year.

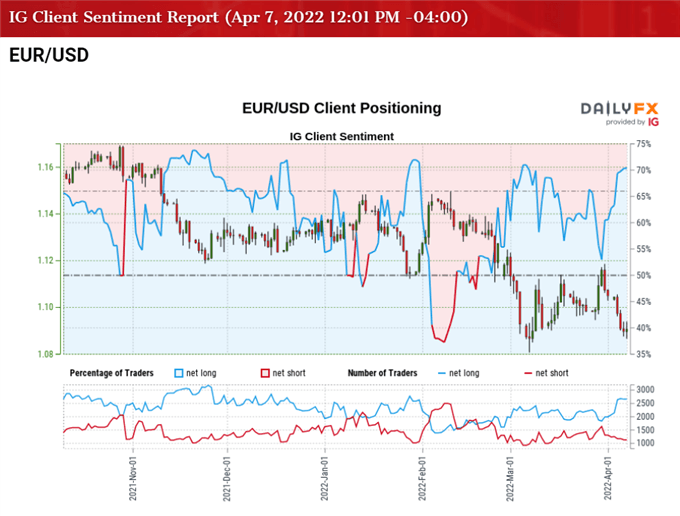

The IG Client Sentiment report shows 68.72% of traders are currently net-long EUR/USD, with the ratio of traders long to short standing at 2.20 to 1.

The number of traders net-long is 2.13% lower than yesterday and 36.46% higher from last week, while the number of traders net-short is 1.59% higher than yesterday and 18.18% lower from last week. The jump in net-long interest has fueled the crowding behavior as 58.99% of traders were net-long EUR/USD last week, while the decline in net-short position could be a function of profit-taking behavior as the exchange rate bounces back from a fresh weekly low (1.0897).

With that said, EUR/USD may face headwinds throughout the year as the FOMC normalizes monetary policy ahead of its European counterpart, but lack of momentum to test the yearly low (1.0806) may keep the exchange rate within a defined range as it snaps the series of lower highs and lows from last week.

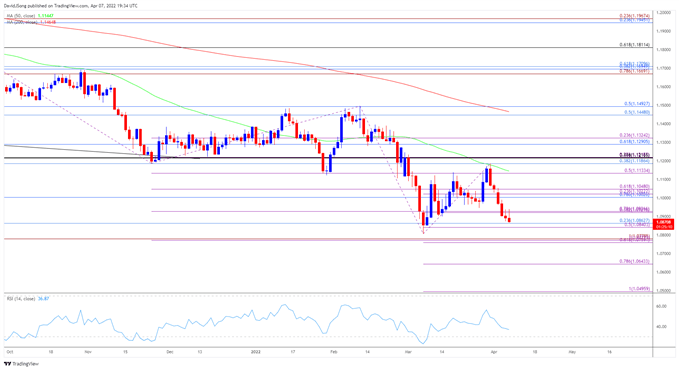

EUR/USD Rate Daily Chart

Source: Trading View

- The broader outlook for EUR/USD remains tilted to the downside as the 200-Day SMA (1.1465) still reflects a negative slope, with the exchange rate clearing the June 2020 low (1.1101) in March after failing to defend the opening range for 2022.

- The decline in EUR/USD pushed the Relative Strength Index (RSI) into oversold territory for the first time this year, but the failed attempt to test the May 2020 low (1.0767) pulled the oscillator out of oversold territory, with the advance from the yearly low (1.0806) generating a test of the 50-Day SMA (1.1145).

- Nevertheless, EUR/USD appears to be reversing course after testing the moving average, with the move below the 1.0920 (38.2% expansion) to 1.0930 (78.6% expansion) region bringing the 1.0840 (50% expansion) to 1.0860 (23.6% retracement) area on the radar.

- A break of the yearly low (1.0806) opens up the 1.0760 (61.8% expansion) to 1.0780 (100% expansion) area, which lines up with the May 2020 low (1.0767), with the next region of interest coming in around 1.0640 (78.6% expansion).

--- Written by David Song, Currency Strategist

Follow me on Twitter at @DavidJSong