Canadian Dollar Talking Points

USD/CAD tracks the opening range for March as it pulls back from the 50-Day SMA (1.2702), but the Bank of Canada (BoC) interest rate decision on March 10 may influence the exchange rate if the central bank adjusts the forward guidance for monetary policy.

USD/CAD Tracks March Opening Range Ahead of BoC Rate Decision

USD/CAD is little changed from the start of the week even as longer-dated US Treasury yields trade above pre-pandemic levels, and more of the same from the BoC may generate a limited market reaction as the central bank is widely expected to retain the current course for monetary policy.

The BoC may merely attempt to buy time as Governor Tiff Macklem and Co. are scheduled to update the Monetary Policy Report (MPR) in April, and the central bank may reiterate its commitment to “continue its QE (quantitative easing) program until the recovery is well underway” as the benchmark interest rate sits at its effective lower bound.

However, the BoC may gradually change its tone over the coming months as the central bank pledges to adjust its QE program “as the Governing Council gains confidence in the strength of the recovery,” and USD/CAD may continue to exhibit the bearish price action seen in 2020 if Governor Macklem and Co. show a greater willingness to switch gears.

Until then, key market themes may continue to influence USD/CAD as the Federal Reserve stays on track to “increase our holdings of Treasury securities by at least $80 billion per month and of agency mortgage-backed securities by at least $40 billion per month,” and the tilt in retail sentiment also looks poised to persist as traders have been May 2020.

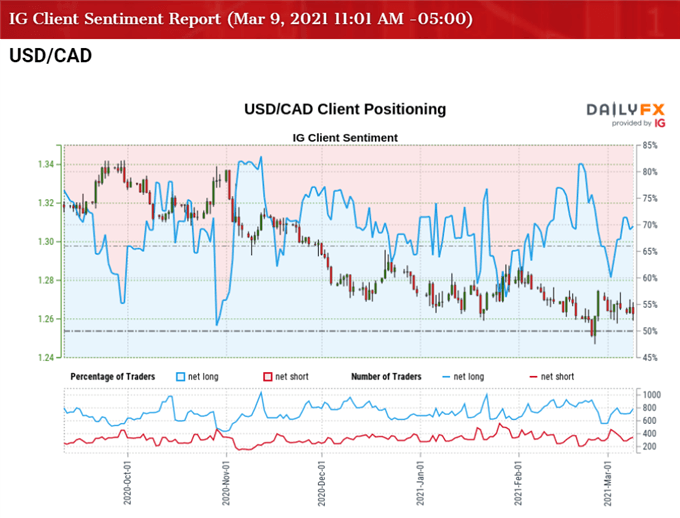

The IG Client Sentiment report shows 67.87% of traders are still net-long USD/CAD, with the ratio of traders long to short standing at 2.11 to 1.

The number of traders net-long is 7.17% higher than yesterday and 11.93% higher from last week, while the number of traders net-short is 8.22% higher than yesterday and 20.91% lower from last week. The rise in net-long interest along with the decline in net-short position has spurred a further tilt in retail sentiment as 60.41% of traders were net-long USD/CAD last week, and the advance from the February low (1.2468) may turn out to be correction in the broader trend rather than a change in behavior like the price action seen in 2020.

With that said, USD/CAD may continue to track the monthly opening range if the BoC rate decision generates a limited reaction, butthe bearish price seen in 2020 may also materialize throughout this year as especially as the exchange rate struggles to hold above the 50-Day SMA (1.2702).

USD/CAD Rate Daily Chart

Source: Trading View

- Keep in mind, USD/CAD cleared the January 2020 low (1.2957) following the US election, with the exchange rate trading to fresh yearly lows in November and December as the Relative Strength Index (RSI) established a downward trend during the same period.

- USD/CAD started off 2021 by taking out last year’s low (1.2688) even though the RSI broke out of the bearish formation, with lack of momentum to hold above the 1.2770 (38.2% expansion) region pushing the exchange rate briefly below the Fibonacci overlap around 1.2620 (50% retracement) to 1.2650 (78.6% expansion).

- A break/close below the Fibonacci overlap around 1.2620 (50% retracement) to 1.2650 (78.6% expansion) materialized in February, which pushed USD/CAD to fresh yearly lows, and advance from the February low (1.2468) may turn out to be correction in the broader trend rather than a change in behavior as the exchange rate struggles to hold above the 50-Day SMA (1.2702).

- It remains to be seen if USD/CAD will continue to respond to the moving average like the price action seen earlier this year, but need a close below the Fibonacci overlap around 1.2620 (50% retracement) to 1.2650 (78.6% expansion) to bring the 1.2510 (78.6% retracement) region back on the radar, with the next area of interest comes in around 1.2440 (23.6% expansion).

--- Written by David Song, Currency Strategist

Follow me on Twitter at @DavidJSong