EUR/USD Rate Talking Points

EUR/USD extends the decline from earlier this week after taking out the January low (1.2054), and the exchange rate may face a larger pullback as the Relative Strength Index (RSI) still tracks the downward trend carried over from December.

EUR/USD Outlook: Break of January Range Keeps Bearish RSI Trend Intact

EUR/USD remains under pressure amid the limited reaction to the Euro Area’s Consumer Price Index (CPI), with the exchange rate carving a series of lower highs and lows ahead of the US Non-Farm Payrolls (NFP) report as it fails to preserve the January range.

It remains to be seen if the update to the NFP report will influence the near-term outlook for EUR/USD as the US economy is expected to add 50K jobs in January, and a rebound in employment may generate a bullish reaction in the US Dollar as it encourages the Federal Reserve to retain the current course for monetary policy.

It seems as though the Federal Open Market Committee (FOMC) will rely on its current tools to achieve its policy targets as the central bank insists that “our forward guidance for the federal funds rate along with our balance sheet guidance will ensure that the stance of monetary policy remains highly accommodative, and Chairman Jerome Powell and Co. may stick to the same script at the next interest rate decision on March 17 as the committee remains “committed to using our full range of tools to support the economy.”

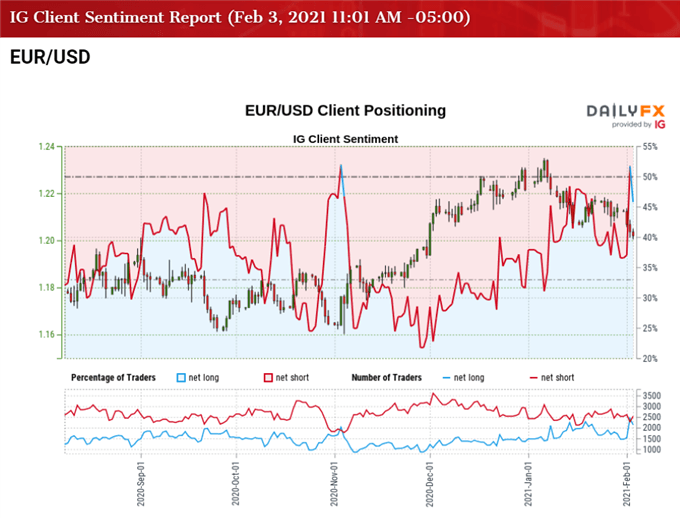

In turn, the US Dollar may continue to reflect an inverse relationship with investor confidence as the Fed stays on track to “increase our holdings of Treasury securities by at least $80 billion per month and of agency mortgage-backed securities by at least $40 billion per month,” and it looks as though the recent shift in retail sentiment is likely to be short lived as the crowding behavior from 2020 resurfaces.

The IG Client Sentiment report shows 46.42% of traders are now net-long EUR/USD after flipping for the first time since November, with the ratio of traders short to long currently standing at 1.15 to 1. The number of traders net-long is 7.14% higher than yesterday and 15.50% higher from last week, while the number of traders net-short is 2.23% higher than yesterday and 17.59% higher from last week.

The rise in net-short position comes as EUR/USD extends the decline from earlier this week to trade to a fresh yearly low (1.2004), while the rise in net-long interest helped to alleviate the tilt in retail sentiment as 44.74% of traders were net-long the pair during the previous week.

With that said, the decline from the January high (1.2350) may turn out to be a correction in the broader trend rather than a change in EUR/USD behavior as the crowding behavior from 2020 resurfaces, and the exchange rate remains susceptible to a larger pullback as long as the Relative Strength Index (RSI) tracks the downward trend established in December.

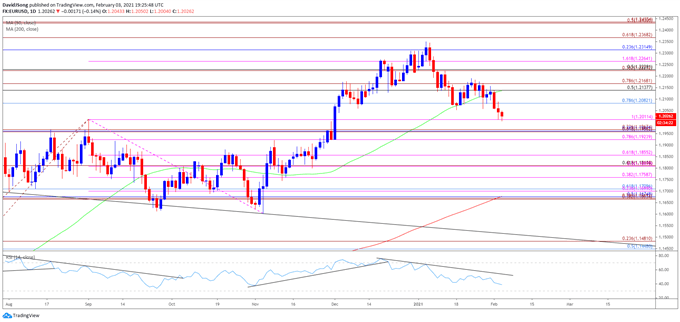

EUR/USD Rate Daily Chart

Source: Trading View

- Keep in mind, the EUR/USDcorrection from the September high (1.2011) proved to be an exhaustion in the bullish price action rather than a change in trend following the string of failed attempts to close below the 1.1600 (61.8% expansion) to 1.1640 (23.6% expansion) region, with the Relative Strength Index (RSI) highlighting a similar dynamic as it broke out of the downward trend carried over from the end of July to recover from its lowest readings since March.

- The break/close above the 1.1960 (38.2% retracement) to 1.1970 (23.6% expansion) region pushed EUR/USD to a fresh yearly highs throughout December, with the exchange rate taking out the 2020 high (1.2310) during the first week of January.

- However, EUR/USD has snapped the opening range for 2021 following the failed attempt to test the April 2018 high (1.2414), with the exchange rate still susceptible to a larger pullback as the RSI continues to track the downward trend established in December.

- EUR/USD carves a series of lower highs and lows following the close below the 1.2080 (78.6% retracement) region along with a break of the January low (1.2054), but need a closing price below 1.2010 (100% expansion) to bring the 1.1960 (61.8% expansion) to 1.1970 (23.6% expansion) area on the radar.

- Next region of interest comes in around 1.1920 (78.6% expansion) followed by the Fibonacci overlap around 1.1810 (50% expansion) to 1.1860 (61.8% expansion).

--- Written by David Song, Currency Strategist

Follow me on Twitter at @DavidJSong