Canadian Dollar Talking Points

USD/CAD pares the decline from earlier this week as the US Dollar appreciates on the back of waning risk appetite, and swings in investor confidence may continue to sway the exchange rate as the threat of protracted recovery puts pressure on major central banks to deploy more non-standard measures.

USD/CAD Outlook: Weekly Range Remains Intact Ahead of G20 Summit

USD/CAD appears to be trading within a defined range after snapping the series of higher high and lows from the previous week, and the exchange rate may consolidate ahead of the virtual Group of 20 (G20) Summit on tap for November 21-22 as the recent surge in COVID-19 cases pushes major cities like New York to implement a growing number of social restrictions.

Despite hopes of a looming vaccine, discussions at the G20 Summit may largely revolve around the downside risks surrounding the global economy, and the group of major central bank leaders may collective endorse a dovish forward guidance as the ongoing pandemic raises the threat for a protracted recovery.

It remains to be seen if Federal Reserve officials will reveal new information ahead of its last meeting for 2020 as the central bank is slated to release the updated the Summary of Economic Projections (SEP) on December 16, and the fresh forecasts from Chairman Jerome Powell and Co. may help to shore up investor confidence as the Federal Open Market Committee (FOMC) remains “committed to using our full range of tools to support the economy and to help assure that the recovery from this difficult period will be as robust as possible.”

However, it seems as though the FOMC will stick to its current tools in 2021 as a growing number of central bank officials show a greater willingness to extend the lending facilities, and key market trends may largely carry into the year ahead as the Fed’s balance sheet approaches the record high.

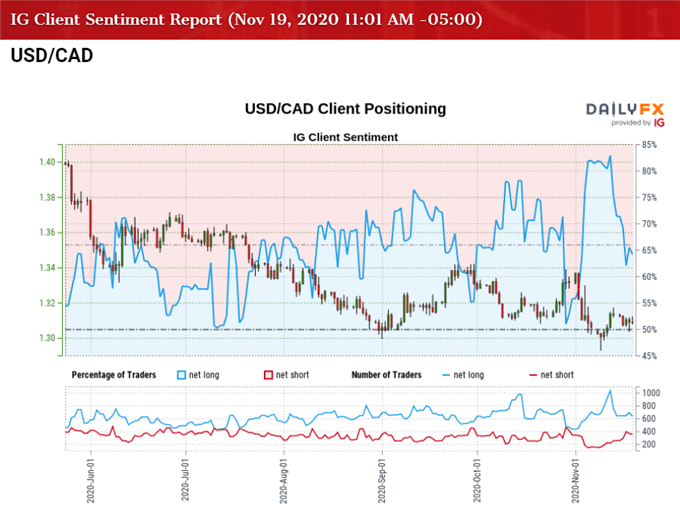

In turn, the US Dollar may continue to reflect an inverse relationship with investor confidence as the FOMC vows to “increase its holdings of Treasury securities and agency mortgage-backed securities at least at the current pace,” and the tilt in retail sentiment also looks poised to persist as traders have been net-long USD/CAD since mid-May.

The IG Client Sentiment report shows 70.91% of traders are net-long with the ratio of traders long to short at 2.44 to 1. The number of traders net-long is 6.31% higher than yesterday and 13.91% lower from last week, while the number of traders net-short is 26.30% lower than yesterday and 36.24% higher from last week.

The rise in net-short position comes as USD/CAD snaps the series of higher highs and lows from the previous week, while the decline in net-long interest has done little to alleviate the tilt in retail sentiment as 62.18% of traders were net-long the pair at the start of the week.

With that said, key market trends may continue to influence USD/CAD as the crowding behavior looks poised to persist over the remainder of the month, but exchange rate may consolidate ahead of the G20 Summit as it appears to be stuck in a defined range.

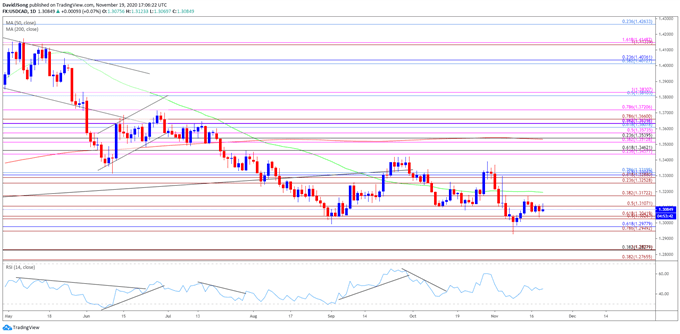

USD/CAD Rate Daily Chart

Source: Trading View

- Keep in mind, the USD/CAD correction from the 2020 high (1.4667) managed to fill the price gap from March, with the decline in the exchange rate pushing the Relative Strength Index (RSI) into oversold territory for the first time since the start of the year.

- USD/CAD managed to track the June range throughout July as the RSI broke out of a downward trend, but the failed attempt to push back above the 1.3440 (23.6% expansion) to 1.3460 (61.8% retracement) region led to a break of the March/June low (1.3315) even though the momentum indicator failed to push into oversold territory.

- The decline from the August high (1.3451) briefly pushed the RSI below 30, but lacked the momentum to produce a test of the January low (1.2957) as the indicator failed to reflect the extreme reading in June.

- In turn, the advance from the September low (1.2994) pushed USD/CAD above the 50-Day SMA (1.3195) for the first time since May, but the exchange rate reversed coursed following the failed attempt to test the August high (1.3451), which largely lines up with the 1.3440 (23.6% expansion) to 1.3460 (61.8% retracement) region.

- A similar scenario took shape in October as USD/CAD tracked the September range, but the exchange rate cleared the January low (1.2957) following the US election to trade to a fresh 2020 low (1.2928).

- However, the failed attempt to close below the 1.2950 (78.6% expansion) to 1.2980 (61.8% retracement) has pushed USD/CAD up against the 1.3170 (38.2% expansion), and the exchange rate may trade within a more defined range over the coming days as it quickly bounces back from the Fibonacci overlap around 1.3030 (50% expansion) to 1.3040 (61.8% expansion).

- Need a break/close below the Fibonacci overlap around 1.3030 (50% expansion) to 1.3040 (61.8% expansion) bringing the 1.2950 (78.6% expansion) to 1.2980 (61.8% retracement) region back on the radar, with the next area of interest coming in around 1.2830 (38.2% retracement).

--- Written by David Song, Currency Strategist

Follow me on Twitter at @DavidJSong