New Zealand Dollar Talking Points

NZD/USD tags a fresh monthly high (0.6158) after failing to test the April low (0.5843), but the recent rebound in the exchange rate appears to be stalling ahead of the former support zone around 0.6170 (50% expansion) to 0.6230 (38.2% expansion) as it struggles to extend the series of higher highs and lows from earlier this week.

NZD/USD Rate Struggles Again at Former Support Zone

NZD/USD continues to track the April range even though the Reserve Bank of New Zealand (RBNZ) expands its Large Scale Asset Purchase (LSAP) programto NZ$60 billion from NZ$33 billion, but the update to New Zealand’s Retail Sales report may produce a bearish reaction in the exchange rate as private sector consumption is expected to contract 1.5% following the 0.7% expansion during the last three months of 2019.

The economic shock from COVID-19 may push the RBNZ to further support the economy as officials favor “delivering stimulus sooner rather than later,” but it seems as though the central bank is in no rush to implement a negative interest rate policy (NIRP) as Governor Adrian Orr insists that “we don’t want to go negative at this point” during an interview with Bloomberg News.

During the post Monetary Policy Statement (MPS) webinar,Chief Economist Yuong Ha tamed speculation for an imminent rate cut as the RBNZ expects to hold the official cash rate (OCR) at the record low until March 2021, with the official going onto say that “we’ve given the banking system until the end of the year to get ready so that the option is there for the Monetary Policy Committee (MPC) in a year’s time.”

The comments suggest the RBNZ will continue to utilize its balance sheet in 2020 as “the Monetary Policy Committee is prepared to use additional monetary policy tools if and when needed,” and Governor Orr and Co. are likely to retain a dovish forward guidance at the next meeting on June 24 even though “members noted that the main thing needed to support the economy is fiscal stimulus.”

With that said, speculation for a NIRP in New Zealand may drag on NZD/USD especially as Federal Reserve Chairman Jerome Powell tames bets for negative US interest rates, but the exchange rate may trade within a more defined range over the coming days as the recent rebound appears to be stalling ahead of the former support zone around 0.6170 (50% expansion) to 0.6230 (38.2% expansion).

Sign up and join DailyFX Currency Strategist David Song LIVE for an opportunity to discuss potential trade setups.

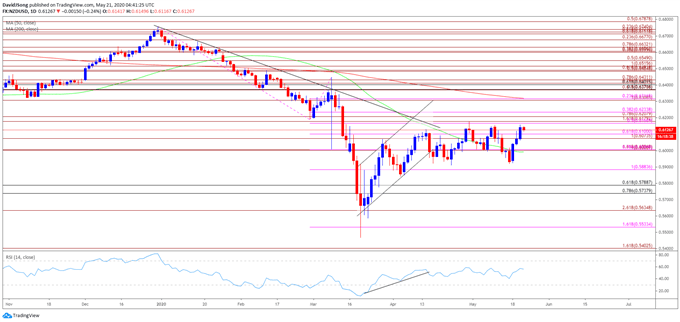

NZD/USD Rate Daily Chart

Source: Trading View

- Keep in mind, NZD/USD has failed to retain the range from the second half of 2019 as the decline from earlier this year produced a break of the October low (0.6204), with a ‘death cross’ taking shape in March as the 50-Day SMA (0.5992) crossed below the 200-Day SMA (0.6319).

- The negative slope in both the 50-Day SMA and the 200-Day SMA offer a bearish outlook for NZD/USD, and the advance from the yearly low (0.5469) appears to appears to be capped by the former support zone around 0.6170 (50% expansion) to 0.6230 (38.2% expansion) as both price and the Relative Strength Index (RSI) snap the bullish formations from March.

- Nevertheless, recent price action warns of range bound conditions as NZD/USD tags a fresh monthly high (0.6158) after failing to test the April low (0.5843), with a move below the 0.6070 (100% expansion) to 0.6100 (61.8% expansion) region bringing the 0.6000 (100% expansion) to 0.6010 (161.8% expansion) area on the radar.

- Need a break of the April low (0.5843) to open up the Fibonacci overlap around 0.5740 (78.6% retracement) to 0.5790 (61.8% retracement), with the next area of interest coming in around 0.5640 (261.8% expansion).

--- Written by David Song, Currency Strategist

Follow me on Twitter at @DavidJSong