Gold Price Talking Points

The price of gold pulls back from a fresh yearly high ($1748) despite the weakening outlook for global growth, and the precious metal may consolidate over the coming days as the Relative Strength Index (RSI) reverses course ahead of overbought territory.

Gold Price Pullback in Focus as RSI Flops Ahead of Overbought Zone

The price of gold struggles to hold its ground even though US Retail Salescontracts 8.7% in March, but the economic shock from the coronavirus may put pressure on the Federal Reserve to deploy more unconventional tools as the Being Book warns “economic activity contracted sharply and abruptly across all regions in the United States as a result of the COVID-19 pandemic.”

The update goes onto say that “all Districts reported highly uncertain outlooks among business contacts, with most expecting conditions to worsen in the next several months,” and theFederal Open Market Committee (FOMC) may take additional steps to curb the slowdown in economic activity as the central bank unveils the ‘Main Street Lending Program’ along with additional unconventional tools in order to “provide powerful support for the flow of credit in the economy.”

It seems as though the Federal Reserve will retain a proactive approach in supporting the US economy as Chairman Jerome Powell pledges to “to use these powers forcefully, proactively, and aggressively until we are confident that we are solidly on the road to recovery,” but it remains to be seen if the central bank will continue to push monetary policy into uncharted territory as Minneapolis Fed President Neel Kashkari, a 2020-voting member on the FOMC, insists that “Congress is playing a very, very important role.”

In turn, Fed officials may call upon US lawmakers to help cushion the US economy as the central bank remains reluctant to implement a negative interest rate policy (NIRP), but Chairman Powell and Co. may have little choice but to endorse a dovish forward guidance at its next rate decision on April 29 as the central bank “remainscommitted to using its full range of tools to support the flow of credit to households and businesses to counter the economic impact of the coronavirus pandemic.”

With that said, the unprecedented efforts by the FOMC may ultimately produce unintended consequences as the Fed relies on its balance sheet to boost economic activity, and the low interest rate environment may continue to act as a backstop for goldas marketparticipants look for an alternative to fiat-currencies.

As a result, the broader outlook for bullion remains constructive as the reaction to the former-resistance zone around $1450 (38.2% retracement) to $1452 (100% expansion) helped to rule out the threat of a Head-and-Shoulders formation, with a similar scenario arising in March as the price of gold reversed course from the monthly low ($1451).

However, the price of bullion may consolidate after trading to a fresh yearly high ($1748) as it fails to extend the series of higher highs and lows from earlier this week, with the Relative Strength Index (RSI) highlighting a similar dynamic as the indicator appears to be reversing course ahead of overbought territory.

Sign up and join DailyFX Currency Strategist David Song LIVE for an opportunity to discuss potential trade setups.

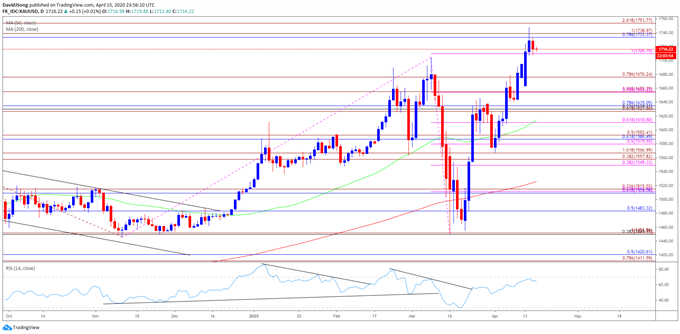

Gold Price Daily Chart

Source: Trading View

- The opening range for 2020 instilled a constructive outlook for the price of gold as the precious metal cleared the 2019 high ($1557), with the Relative Strength Index (RSI) pushing into overbought territory during the same period.

- A similar scenario materialized in February, with the price of gold marking the monthly low ($1548) during the first full week, while the RSI broke out of the bearish formation from earlier this year to push back into overbought territory.

- However, the monthly opening range for March as less relevant amid the pickup in volatility, with the decline from the monthly high ($1704) leading to a break of the January low ($1517).

- Nevertheless, the reaction to the former-resistance zone around $1450 (38.2% retracement) to $1452 (100% expansion) instilled a constructive outlook for bullion especially as the RSI reversed course ahead of oversold territory and broke out of the bearish formation carried over from the previous month.

- The break/close above $1710 (100% expansion) pushed the price of gold to a fresh yearly high ($1748), but the sting of failed attempts to close above the Fibonacci overlap around $1733 (78.6% retracement) to $1739 (100% expansion) may generate a short-term pullback as the bullish momentum appears to be abating.

- Recent developments in the RSI suggest the bullish momentum will abate over the coming days as the oscillator fails to push above 70 and reverses course ahead of overbought territory.

--- Written by David Song, Currency Strategist

Follow me on Twitter at @DavidJSong