Gold Price Talking Points

The price of gold approaches the yearly high ($1689) as the Federal Reserve responds to COVID-19, and the threat posed by the coronavirus may keep the precious metal afloat as the outbreak dampens the outlook for global growth.

Gold Price Eyes Yearly High Following Federal Reserve Rate Cut

The recent pullback in the price of gold was short lived as the Federal Reserve announces an unexpected 50bp rate cut ahead of its interest rate decision on March 18, and the central bank may take additional steps to combat the coronavirus as Chairman Jerome Powell pledges to “act as appropriate to support the economy.”

The comments suggest the Federal Open Market Committee (FOMC) will continue to alter the course for monetary policy as “the virus and the measures that are being taken to contain it will surely weigh on economic activity.” As a result, the FOMC may implement lower interest rates throughout 2020 as the “Committee judged that the risks to the U.S. outlook have changed materially.”

In turn, the update to the Summary of Economic Projections (SEP) may reflect a major shift in the forward guidance, and Fed officials are likely to forecast a lower trajectory for the benchmark interest rate even though the central bank insists that “the fundamentals of the U.S. economy remain strong.”

With that said, the price of gold may continue to benefit from the low interest environment as market participants look for an alternative to fiat-currencies, and the broader outlook for bullion remains constructive as the reaction to the former-resistance zone around $1447 (38.2% expansion) to $1457 (100% expansion) helped to rule out the threat of a Head-and-Shoulders formation.

Sign up and join DailyFX Currency Strategist David Song LIVE for an opportunity to discuss potential trade setups.

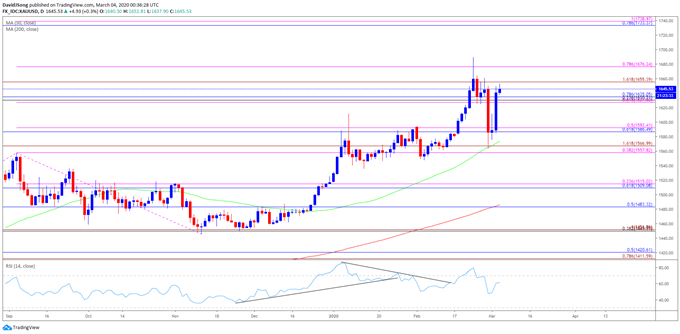

Gold Price Daily Chart

Source: Trading View

- The opening range for 2020 instilled a constructive outlook for the price of gold as the precious metal cleared the 2019 high ($1557), with the Relative Strength Index (RSI) pushing into overbought territory during the same period.

- A similar scenario materialized in February, with the price of gold marking the monthly low ($1548) during the first full week, while the RSI broke out of the bearish formation from earlier this year to push back into overbought territory.

- In turn, the monthly opening range for March is in focus as the price of gold carves a series of higher highs and lows following the failed attempt to break/close below the Fibonacci overlap around $1558 (38.2% expansion) to $1592 (161.8% expansion).

- A break/close above $1655 (161.8% expansion) may spur a run at the yearly high ($1689), but need a break/close above $1676 (78.6% expansion) to open up the Fibonacci overlap around $1733 (78/6% retracement) to $1739 (100% expansion).

--- Written by David Song, Currency Strategist

Follow me on Twitter at @DavidJSong