Australian Dollar Talking Points

AUD/USD snaps the series of lower highs and lows from the first full week of January, and developments surrounding the US-China trade deal may keep the exchange rate afloat as it instills an improved outlook for global growth.

AUD/USD Rate Outlook Hinges on Details of US-China Trade Deal

AUD/USD halts the longest stretch of decline since July as the US Non-Farm Payrolls (NFP) report showed the economy adding 145K jobs in December versus forecasts for 160K print.

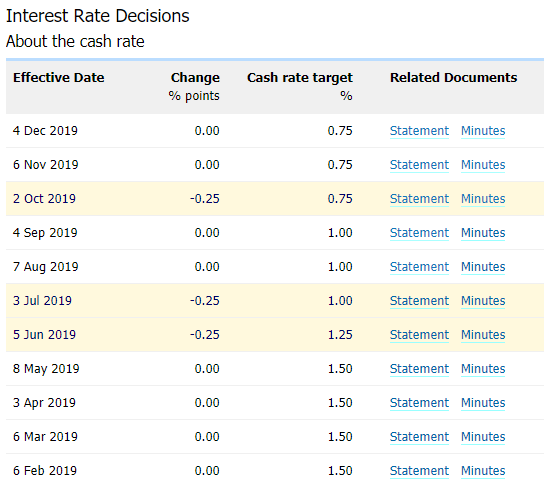

The reaction raises the scope for a near-term correction in AUD/USD as the US and China, Australia’s largest trading partner, appear to be on track to sign the Phase One trade deal later this week, and the development may encourage the Reserve Bank of Australia (RBA) to retain the current policy at the next meeting on February 4 as President Donald Trump pledges to visit Beijing at a later date “where talks will begin on Phase Two.”

The narrowing threat of a US-China trade war may spark a bullish reaction in the Australian Dollar as it curbs speculation for an RBA rate cut in 2020, but the details of the Phase One trade deal may foreshadow less demand for Australian exports as Chinese officials pledge to boost purchases of US goods.

In turn, the RBA may respond to the slowdown in global trade and keep the door open to implement lower interest rates as Governor Philip Lowe and Co. insist that the board has “the ability to provide further stimulus.”

It remains to be seen if the RBA will alter the forward guidance for monetary policy as “the Australian economy appears to have reached a gentle turning point,” but the central bank may come under pressure to provide additional support as the International Monetary Fund (IMF) warns that “unconventional monetary policy measures such as quantitative easing may become necessary.”

With that said, the RBA may continue to push monetary policy into uncharted territory, and AUD/USD may face a more bearish fate over the coming months as the Federal Reserve moves way from its rate easing cycle.

Sign up and join DailyFX Currency Strategist David Song LIVE for an opportunity to discuss potential trade setups.

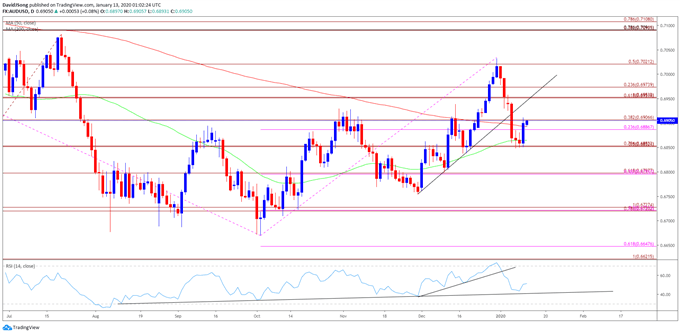

AUD/USD Rate Daily Chart

Source: Trading View

- AUD/USD has been capped by the 200-Day SMA (0.6893) for most of 2019, but the recent break/close above the moving average signaled a potential shift in market behavior especially as the Relative Strength Index (RSI) pushed into overbought territory for the first time since 2018.

- However, the bullish momentum appears to be abating as the RSI falls back from overbought territory and flashes a textbook sell signal, with the oscillator snapping the upward trend from December.

- In turn, the correction from the 2019 low (0.6671) may continue to unravel as it failed to produce a test of the July high (0.7082), with the opening range for 2020 highlighting a similar a similar dynamic as the exchange rate extends the decline from the December high (0.7032).

- Need a break/close below the 0.6850 (78.6% expansion) region to open up the 0.6800 (61.8% expansion) handle, with the next area of interest coming in around 0.6720 (78.6% expansion) to 0.6730 (100% expansion).

--- Written by David Song, Currency Strategist

Follow me on Twitter at @DavidJSong.