Canadian Dollar Talking Points

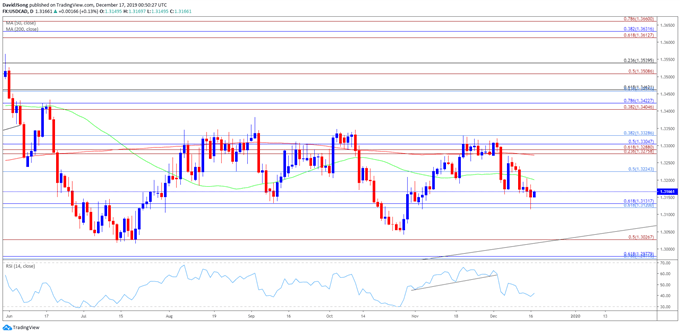

USD/CAD bounces back from a fresh monthly low (1.3115) despite a 0.6% rise in Canada Existing Home Sales, but the opening range for December casts a bearish outlook for the exchange rate amid the failed attempt to test the November high (1.3328).

USD/CAD Analysis: Canadian Dollar Strength Abates Amid Delayed USMCA

The recent strength in the Canadian Dollar appears to abating even though the Office of the US Trade Representative attempts to ease concerns surrounding the United States-Mexico-Canada Agreement (USMCA) as Senate Majority Leader Mitch McConnell insists that the “long delay means it can't become law until 2020.”

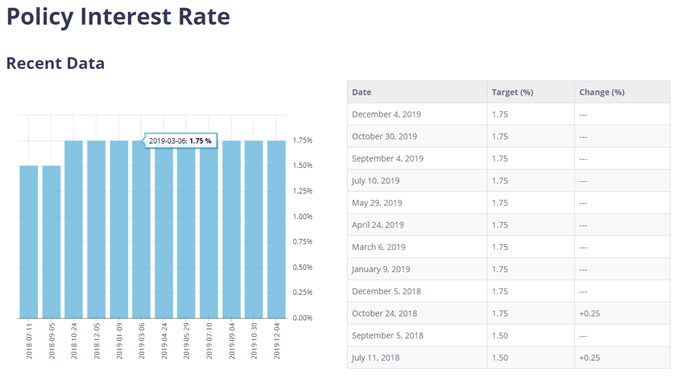

In response, Bank of Canada (BoC) Governor Stephen Poloz warns that “the near-term risks around productivity growth are tilted to the downside,” and the central bank may adopt a more cautious tone over the coming months as “it looks like the global economy is set for continued slow economic growth.”

As a result, the BoC may come under pressure to reverse the rate hikes from 2018, and the central bank may start to prepare Canadian households and businesses for lower interest rates as “uncertainty about the future of trade policies and critical institutions like the World Trade Organization is having a more insidious effect.”

However, it seems as though the BoC is in no rush to alter the forward guidance for monetary policy as “Canada’s economy is operating close to capacity,” and the central bank may stick to the same script at the next meeting on January 22 as “future interest rate decisions will be guided by the Bank’s continuing assessment of the adverse impact of trade conflicts against the sources of resilience in the Canadian economy.”

With that said, it remains to be seen if the BoC will follow its major counterparts in 2020, but the wait-and-see approach for monetary policy may keep USD/CAD within the range-bound price action from the third quarter as the Federal Reserve concludes its rate easing cycle.

In turn, the rebound from the October low (1.3042) may continue to unravel as USD/CAD fails to test the November high (1.3328) during the first week of December.

Sign up and join DailyFX Currency Strategist David Song LIVE for an opportunity to discuss potential trade setups.

USD/CAD Rate Daily Chart

Source: Trading View

- Keep in mind, the rebound from the 2019 low (1.3016) has failed to generate a test of the Fibonacci overlap around 1.3410 (38.2% expansion) to 1.3420 (78.6% retracement), with USD/CAD largely tracking sideways as it remains stuck in the range bound price action from the third quarter.

- At the same time, the flattening slopes in the 50-Day (1.3200) and 200-Day SMA (1.3272) warn of range-bound conditions as the moving averages look poised to converge with one another.

- More recently, USD/CAD appears to have marked a string of failed attempts to test the October high (1.3348), with the monthly opening range for December instilling a bearish outlook amid the lack of momentum to test the November high (1.3328).

- At the same time, the Relative Strength Index (RSI) highlights a similar dynamic as the oscillator snaps the upward trend carried over from the previous month.

- Need a break/close below the Fibonacci overlap around 1.3120 (61.8% retracement) to 1.3130 (61.8% retracement) to open up the 1.3030 (50% expansion) region, which largely lines up with the 2019 low (1.3016).

- However, lack of momentum to clear the Fibonacci overlap around 1.3120 (61.8% retracement) to 1.3130 (61.8% retracement) may spur a move towards 1.3229 (50% retracement), with the next area of interest coming in around 1.3280 (23.6% expansion) to 1.3330 (38.2% retracement), which lines up with the monthly high (1.3321).

Additional Trading Resources

Are you looking to improve your trading approach? Review the ‘Traits of a Successful Trader’ series on how to effectively use leverage along with other best practices that any trader can follow.

Want to know what other currency pairs the DailyFX team is watching? Download and review the Top Trading Opportunities for 2019.

--- Written by David Song, Currency Strategist

Follow me on Twitter at @DavidJSong.