Canadian Dollar Talking Points

USD/CAD pares the advance following the US Non-Farm Payrolls (NFP) report and the monthly opening range casts a bearish outlook for the exchange rate amid the failed attempt to test the November high (1.3328).

USD/CAD Forecast: Post NFP Rebound Unravels Amid Hopes for USMCA

USD/CAD struggles to retain the reaction to the 266K expansion in US employment as Senate Majority Leader Mitch McConnell insists there are “hopeful signals” that Congress will pass the United States-Mexico-Canada Agreement (USMCA) over the coming days.

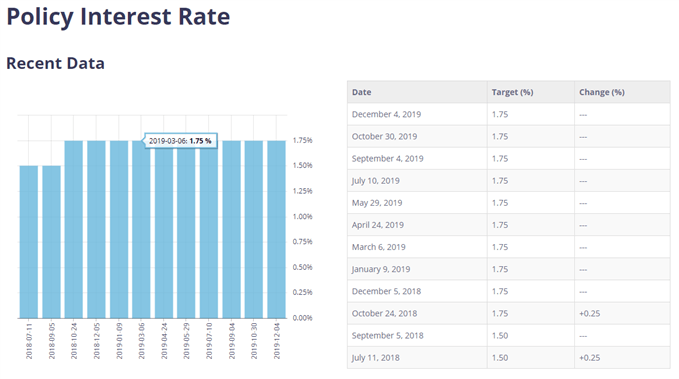

Indications of a looming trade deal appears to be heightening the appeal of the Canadian Dollar as it encourages the Bank of Canada (BoC) to retain the current policy for the foreseeable future.

Recent remarks coming out of the BoC suggest Governor Stephen Poloz and Co. are in no rush to reverse the rate hikes from 2018 as “the Bank continues to expect inflation to track close to the 2 percent target over the next two years.”

Moreover, Deputy Governor Timothy Lane insists that “the current setting of the policy interest rate remains appropriate to keep inflation at our 2 percent target,” and it seems as though the BoC will endorse a wait-and-see approach at the next meeting on January 22 as future “interest rate decisions will be guided by our continuing assessment of the economic impact of trade conflicts.”

The USMCA may give the BoC additional scope to retain the current policy even though Canada Employment unexpectedly contracts 71.2K in November, and Governor Poloz and Co. may continue to tame speculation for an insurance rate cut as the central bank anticipates “global growth will edge higher over the next couple of years.”

In turn, the BoC may largely stick to the same script in 2020, and USD/CAD may continue to track the range-bound price action from the third quarter as the Federal Reserve shows a greater willingness to take a break from its rate easing cycle.

With that said, the rebound from the October low (1.3042) may continue to unravel as USD/CAD fails to test the November high (1.3328) during the first week of December.

Sign up and join DailyFX Currency Strategist David Song LIVE for an opportunity to discuss potential trade setups.

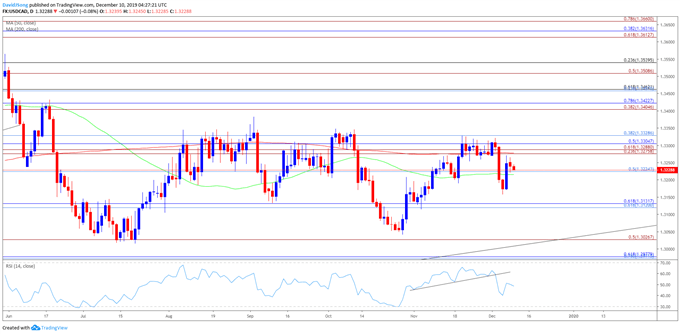

USD/CAD Rate Daily Chart

Source: Trading View

- Keep in mind, the rebound from the 2019 low (1.3016) has failed to generate a test of the Fibonacci overlap around 1.3410 (38.2% expansion) to 1.3420 (78.6% retracement), with USD/CAD largely tracking sideways as it remains stuck in the range bounce price action from the third quarter.

- At the same time, the flattening slopes in the 50-Day (1.3216) and 200-Day SMA (1.3278) warn of range-bound conditions as the moving averages look poised to converge with one another.

- More recently, USD/CAD appears to have marked a string of failed attempts to test the October high (1.3348), with the monthly opening range for December instilling a bearish outlook amid the lack of momentum to test the November high (1.3328).

- At the same time, the Relative Strength Index (RSI) highlights a similar dynamic as the oscillator snaps the upward trend carried over from the previous month.

- Another move below the 1.3220 (50% retracement) region may spur a more meaningful run at the Fibonacci overlap around 1.3120 (61.8% retracement) to 1.3130 (61.8% retracement), with the next area of interest coming in around 1.3030 (50% expansion), which largely lines up with the 2019 low (1.3016).

Additional Trading Resources

Are you looking to improve your trading approach? Review the ‘Traits of a Successful Trader’ series on how to effectively use leverage along with other best practices that any trader can follow.

Want to know what other currency pairs the DailyFX team is watching? Download and review the Top Trading Opportunities for 2019.

--- Written by David Song, Currency Strategist

Follow me on Twitter at @DavidJSong.