Gold Price Talking Points

The price of gold climbs to a fresh yearly high ($1555) amid growing tensions between the US and China, and current market conditions are likely to keep bullion afloat as there appears to be a flight to safety.

Gold Prices Climb to Fresh 2019 High as US and China Boost Tariffs

Gold prices may continue to exhibit a bullish behavior as China boosts tariffs on the US, with President Donald Trump responding by announcing that “starting on October 1st, the 250 billion Dollars of goods and products from China, currently being taxed at 25%, will be taxed at 30%.”

In addition, the “remaining 300 billion Dollars of goods and products from China, that was being taxed from September 1st at 10%, will now be taxed at 15%,” and the growing threat of trade war may become a growing concern for the Federal Reserve as “trade policy uncertainty seems to be playing a role in the global slowdown.”

In turn, the Federal Open Market Committee (FOMC) may come under increased pressure to implement a rate easing cycle, but it remains to be seen if the central bank will reverse the four rate hikes from 2018 as Chairman Jerome Powell argues that monetary policy “cannot provide a settled rulebook for international trade.”

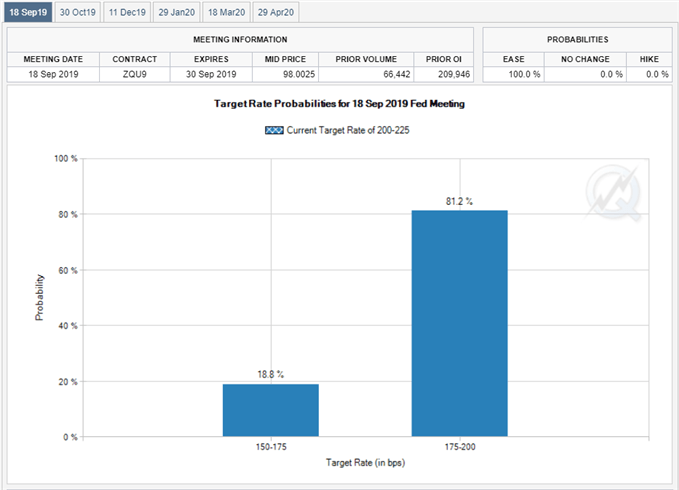

Nevertheless, Fed Fund futures continue to reflect overwhelming expectations for a 25bp reduction on September 18, with the figures now showing renewed speculation for a 50bp rate cut as the ongoing shift in trade policy dampens the outlook for the US economy.

Little signs of a US-China trade deal may push a growing number of Fed officials to change their tune, and the FOMC may continue to alter the forward guidance for monetary policy as “committee participants have generally reacted to these developments and the risks they pose by shifting down their projections of the appropriate federal funds rate path.”

With that said, falling US Treasury yields along with the inverting yield curve may push market participants to hedge against fiat currencies, and the risk of a policy error may keep gold prices afloat as there appears to be a flight to safety.

Sign up and join DailyFX Currency Strategist David Song LIVE for an opportunity to discuss potential trade setups.

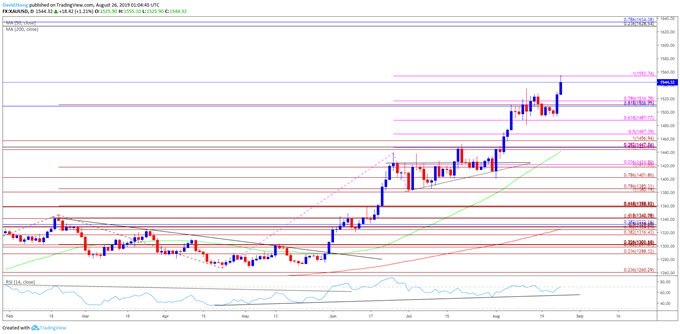

Gold Price Daily Chart

Source: Trading View

- Keep in mind, the broader outlook for gold prices remain constructive as both price and the Relative Strength Index (RSI) clear the bearish trends from earlier this year.

- Moreover, gold has broken out of a near-term holding pattern following the failed attempt to close below the $1402 (78.6% expansion) region, with the RSI still tracking the bullish formation from April.

- More recently, gold climbs to a fresh yearly-high ($1555) following the failed attempts to close below the $1488 (61.8% expansion), but need break/close above $1554 (100% expansion) to open up the Fibonacci overlap around $1629 (23.6% retracement) to $1634 (78.6% retracement).

- Will keep a close eye on the RSI as it works its way towards overbought territory, with a break above 70 likely to be accompanied by higher gold prices as the bullish momentum gathers pace.

For more in-depth analysis, check out the 3Q 2019 Forecast for Gold

Additional Trading Resources

Are you looking to improve your trading approach? Review the ‘Traits of a Successful Trader’ series on how to effectively use leverage along with other best practices that any trader can follow.

Want to know what other currency pairs the DailyFX team is watching? Download and review the Top Trading Opportunities for 2019.

--- Written by David Song, Currency Strategist

Follow me on Twitter at @DavidJSong.