Canadian Dollar Talking Points

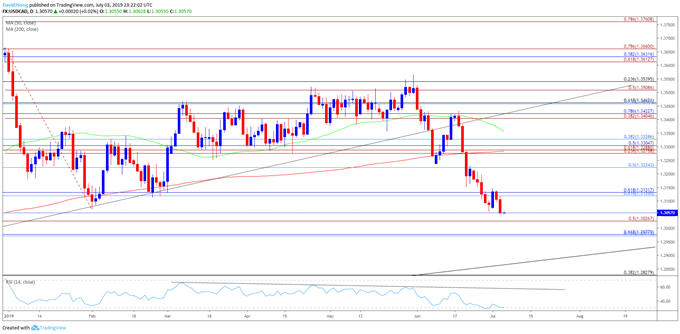

USDCAD trades to a fresh yearly-low (1.3055) as the Canadian economy appears to be outperforming its US counterpart, and the exchange rate may continue to exhibit a bearish behavior over the remainder of the week as the Relative Strength Index (RSI) flirts with oversold territory.

USDCAD Rate Searches for Support, RSI Flirts with Oversold Territory

USDCAD continues to search for support following the Federal Reserve meeting as fresh data prints coming out of the US indicate a slowing economy, and it seems as though it will only be a matter of time before the Federal Open Market Committee (FOMC) switches gears as the central bank alters the forward guidance for monetary policy.

The fresh updates to the ADP Employment survey does not bode well for the highly anticipated Non-Farm Payrolls (NFP) report as the gauge shows a 102K expansion in private-sector employment versus forecasts for a 140K print in June.

The ISM Non-Manufacturing survey highlights a similar dynamic as the employment component narrows to 55.0 from 58.1 in May, and signs of slower job growth may push the Fed to insulate the economy as “many FOMC participants now see that the case for a somewhat more accommodative policy has strengthened.”

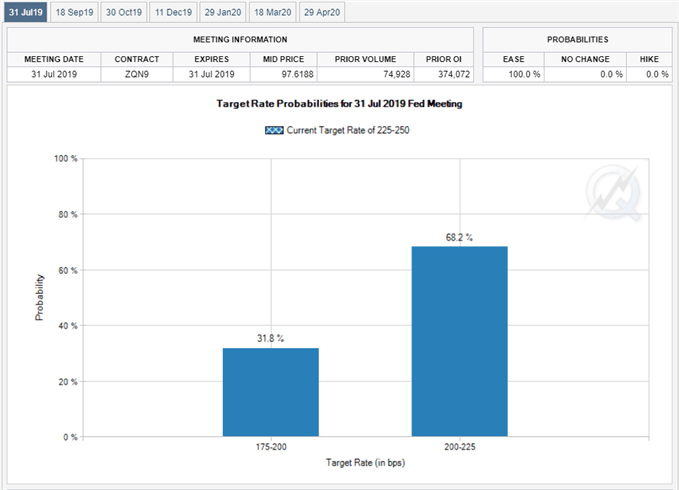

In turn, Fed Fund futures continue to reflect a 100% probability for at least a 25bp reduction on July 31, and Chairman Jerome Powell and Co. may come under pressure to reverse the four rate hikes from 2018 as US President Donald Trump tweets “we need rates cuts, & easing.”

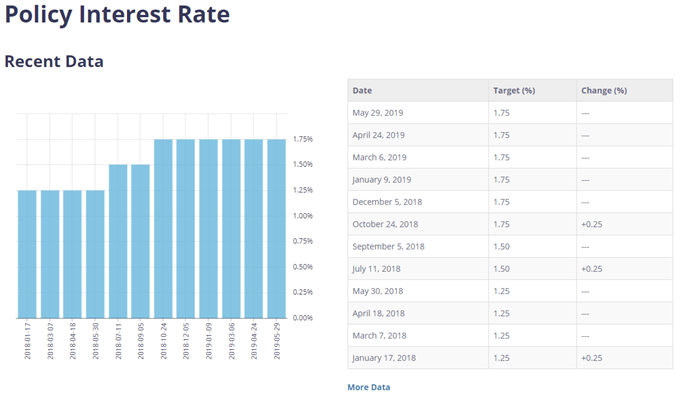

In contrast, the Bank of Canada (BoC) may continue to endorse a wait-and-see approach at the next meeting on July 10 as Canada unexpectedly posts a trade surplus of 0.76B in May, and it seems as though Governor Stephen Poloz and Co. may keep the benchmark interest rate on hold throughout 2019 as “recent data have reinforced Governing Council’s view that the slowdown in late 2018 and early 2019 was temporary.”

As a result, the diverging paths for monetary policy may continue to drag on USDCAD, with the exchange rate at risk of exhibiting a more bearish behavior over the near-term as it snaps the upward trend from earlier this year.

Sign up and join DailyFX Currency Strategist David Song LIVE for an opportunity to discuss potential trade setups.

USD/CAD Rate Daily Chart

- Broader outlook for USDCAD is no longer constructive as the advance from the April-low (1.3274) stalls ahead of the 2019-high (1.3665), with the break of trendline support raising the risk for a further decline in the exchange rate.

- Downside targets are still on the radar as USDCAD clears the February-low (1.3068), with a break/close below 1.3020 (50% expansion) opening up the Fibonacci overlap around 1.2970 (78.6% retracement) to 1.2980 (61.8% retracement).

- Will keep a close eye on the Relative Strength Index (RSI) as it flirts with oversold territory, with a break below 30 raises the risk for a further decline in USDCAD as the bearish momentum gathers pace, but failure to push into oversold territory raises the risk for a rebound in the exchange rate.

Additional Trading Resources

Are you looking to improve your trading approach? Review the ‘Traits of a Successful Trader’ series on how to effectively use leverage along with other best practices that any trader can follow.

Want to know what other currency pairs the DailyFX team is watching? Download and review the Top Trading Opportunities for 2019.

--- Written by David Song, Currency Strategist

Follow me on Twitter at @DavidJSong.