Australian Dollar Talking Points

AUD/USD tracks the monthly opening range ahead of the Reserve Bank of Australia’s (RBA) semi-annual Financial Stability Review (FSR), and the aussie-dollar exchange rate may continue to consolidate over the coming days as it appears to be stuck in a wedge/triangle formation.

AUDUSD April Range in Focus Ahead of RBA Financial Stability Review

AUD/USD attempts to retrace the decline following the RBA meeting as the U.S. and China, Australia’s largest trading partner, appear to be on track to finalize a trade agreement, but the development may do little to alleviate the downside risks surrounding the Australian economy as the central bank endorse a wait-and-see approach for monetary policy.

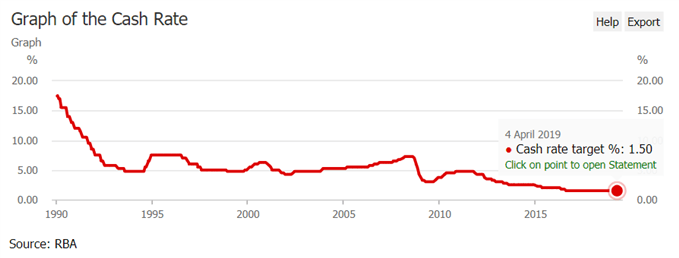

Updates to the RBA’s Financial Stability Review (FSR) may produce headwinds for the Australian dollar as the central bank warns that ‘growth has slowed and downside risks have increased,’ and Governor Philip Lowe & Co. may show a greater willingness to insulate the economy as ‘growth in household consumption is being affected by the protracted period of weakness in real household disposable income and the adjustment in housing markets.’

In turn, the RBA may insist that ‘the low level of interest rates is continuing to support the Australian economy’ at the next meeting on May 7, but the central bank may continue to adjust the forward-guidance for monetary policy as officials see ‘scenarios where an increase in the cash rate would be appropriate at some point and other scenarios where a decrease in the cash rate would be appropriate.’

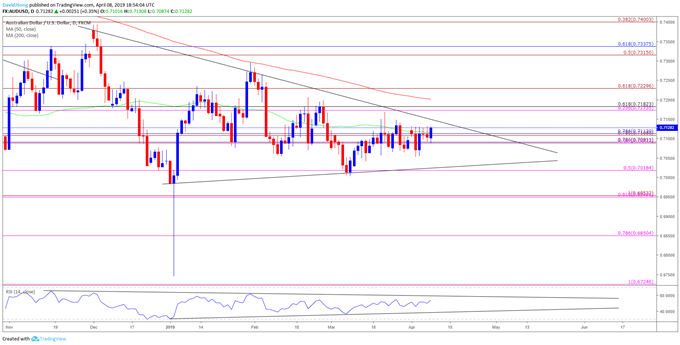

With that said, AUD/USD may continue to consolidate over the near-term as it appears to be stuck in a wedge/triangle formation, with the monthly opening range on the radar as the Relative Strength Index (RSI) highlights a similar dynamic. Sign up and join DailyFX Currency Analyst David Song LIVE for an opportunity to discuss potential trade setups.

AUD/USD Rate Daily Chart

- Keep in mind, the AUD/USD rebound following the currency market flash-crash has been capped by the 200-Day SMA (0.7201), with the exchange rate still tracking the bearish trend from late-2018 as the rebound from the March-low (0.7003) fails to push aussie-dollar back above the Fibonacci overlap around 0.7170 (23.6% expansion) to 0.7180 (61.8% retracement).

- However,AUD/USD appears to be stuck in a wedge/triangle formation, with the Relative Strength Index (RSI) also generating a mixed signal as the oscillator highlights a similar dynamic.

- In turn, need a break of the April-low (0.7053) to open up the 0.7020 (50% expansion) area, which sits just above the March-low (0.7003).

Additional Trading Resources

Are you looking to improve your trading approach? Review the ‘Traits of a Successful Trader’ series on how to effectively use leverage along with other best practices that any trader can follow.

Want to know what other currency pairs the DailyFX team is watching? Download and review the Top Trading Opportunities for 2019

--- Written by David Song, Currency Analyst

Follow me on Twitter at @DavidJSong.