Talking Points:

- USD/JPY Tumbles as Japan’s Finance Minister Undermines Bets for BoJ Easing.

- USDOLLAR Pares Losses Ahead of FOMC on Better-Than-Expected U.S. Data.

Avoid the pitfalls of trading by steering clear of classic mistakes. Review these principles in the "Traits of Successful Traders" series.

Chart - Created by David Song

- USD/JPY may continue to give back the rebound from the June low (98.78) as it fails to preserve the series of higher highs & lows from earlier this month; failure to close above 106.60 (61.8% retracement) to 107.00 (61.8% expansion) may highlight a near-term top especially as the Relative Strength Index (RSI) appears to be turning over to preserve the bearish formation carried over from the previous year.

- Recent comments from Japan’s Finance Minister appear to be dampening expectations for additional monetary support as Mr. Taro Aso argues in favor of the Bank of Japan’s (BoJ) independence and says monetary policy should be left to Governor Haruhiko Kuroda and Co; may foreshadow the market reaction to the interest-rate decision on July 29 should the central bank stick to the sidelines.

- Next downside hurdle come sin around 103.20 (38.2% retracement) to 103.60 (38.2% retracement) followed by 101.80 (23.6% retracement) to 102.10 (100% expansion).

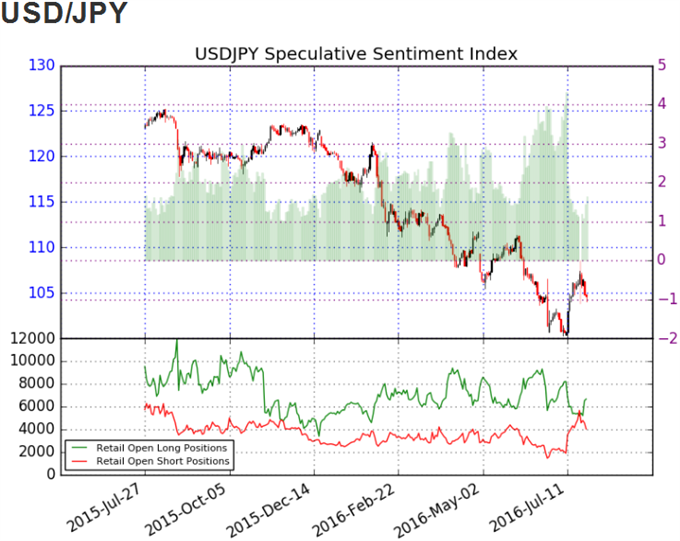

- The DailyFX Speculative Sentiment Index (SSI) shows the retail crowd has flipped back net-long USD/JPY on July 22, with the hitting an extreme reading earlier this month as the ratio climbed to +5.28.

- The ratio currently sits at +1.63 as 62% of traders are long, with long positions 29.8% higher from the previous week, while open interest stands 14.4% above the monthly average.

Why and how do we use the SSI in trading? View our video and download the free indicator here

USDOLLAR(Ticker: USDollar):

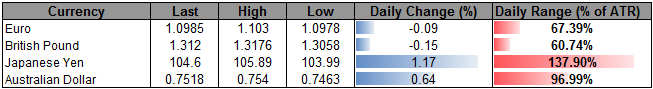

| Index | Last | High | Low | Daily Change (%) | Daily Range (% of ATR) |

|---|---|---|---|---|---|

| US Dollar Index | 12062.83 | 12097.25 | 12041.69 | -0.24 | 110.68% |

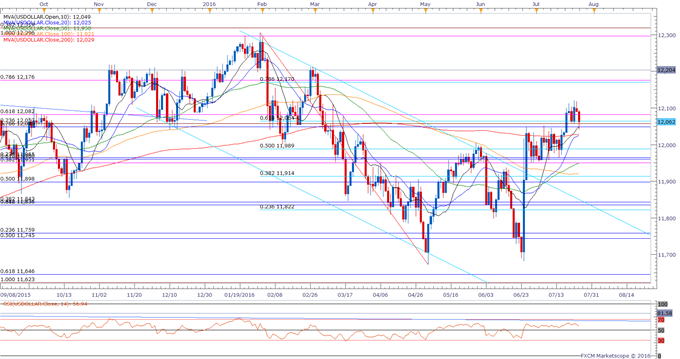

Chart - Created by David Song

- The USDOLLAR dollar bounced back from a low of 12,041 following the slew of better-than-expected data, but failure to hold/close above 12,049 (78.6% retracement) to 12,064 (61.8% retracement) may spark a larger pullback in the USDOLLAR, with the greenback at risk of facing near-term headwinds as the Federal Reserve is widely anticipated to retain its current policy at the July interest-rate decision.

- With the Federal Open Market Committee (FOMC) widely anticipated to retain the current policy in July, central bank officials may keep the door open to raise the benchmark interest rate at the next quarterly meeting in September, but Chair Janet Yellen may stick to the sidelines ahead of the Presidential election in November amid the uncertainty surrounding the fiscal outlook.

- A closing price below 12,049 (78.6% retracement) to 12,064 (61.8% retracement) may open up the downside targets, with the first area of interest coming in around 11,951 (38.2% expansion) to 11,965 (23.6% retracement).

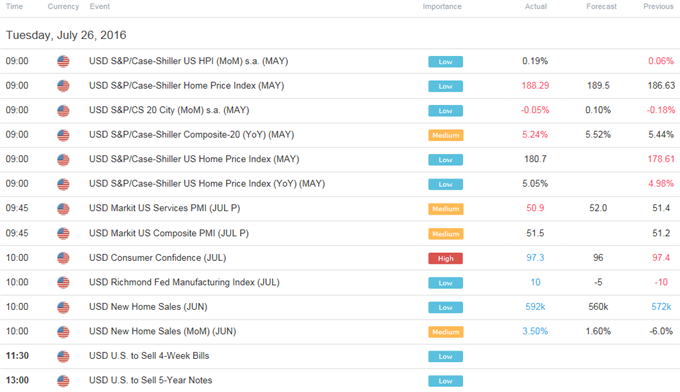

Click Here for the DailyFX Calendar

Get our top trading opportunities of 2016 HERE

Read More:

S&P 500: Sharply Unchanged, Consolidating or Topping?

COT-British Pound Ownership Profile Warns of a Bottom

Post-Brexit NZDUSD Support Vulnerable to Weak NZ Trade Balance

USD/JPY July Recovery at Risk on Wait-and-See FOMC/BoJ Policy

--- Written by David Song, Currency Analyst

To contact David, e-mail dsong@dailyfx.com. Follow me on Twitter at @DavidJSong.

To be added to David's e-mail distribution list, please follow this link.