Talking Points:

- AUD/USD Breaks Higher Following Wait-and-See RBA; 0.7500 Up Next?

- USDOLLAR Extends Losses Following Dovish Comments from Fed Chair Yellen.

Avoid the pitfalls of trading by steering clear of classic mistakes. Review these principles in the "Traits of Successful Traders" series.

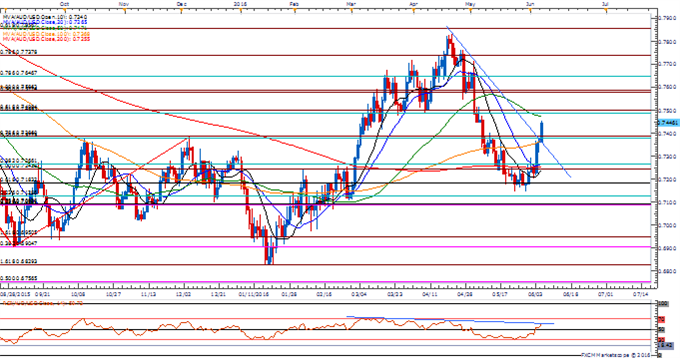

Chart - Created by David Song

Following the failed attempt to break/close below 0.7130 (23.6% retracement), AUD/USD may continue to retrace the decline from the end of April as the pair breaks out of the near-term downward trend; will keep a close eye on the Relative Strength Index (RSI) as the oscillator approaches trendline resistance, with a topside break providing conviction/confirmation for a larger recovery.

- Even though the Reserve Bank of Australia (RBA) retains a cautious outlook for the region, may see Governor Glenn Stevens and Co. largely endorse a wait-and-see approach throughout 2016 as the current policy is ‘consistent with sustainable growth in the economy and inflation returning to target over time.

- Will keep a close eye on the topside targets following the RBA meeting, with the first region of interest coming in around 0.7490 (61.8% retracement) to 0.7500 (61.8% expansion), followed by 0.7580 (50% expansion) to 0.7590 (100% expansion).

- The DailyFX Speculative Sentiment Index (SSI) shows the retail FX crowd remains net-long AUD/USD since May 3, with the ratio hitting a near-term extreme at the end of the previous month as it climbed to +2.25.

- The ratio continues to come off of the extreme reading as it currently sits at +1.04 as 51% of traders are long, with short positions 23.2% higher from the previous week as open interest stands 2.3% above the monthly average.

Why and how do we use the SSI in trading? View our video and download the free indicator here

USDOLLAR(Ticker: USDollar):

| Index | Last | High | Low | Daily Change (%) | Daily Range (% of ATR) |

|---|---|---|---|---|---|

| US Dollar Index | 11831.29 | 11875.83 | 11820.74 | -0.35 | 125.22% |

Chart - Created by David Song

- The USDOLLAR extends the decline from earlier this week, with the greenback at a risk for further losses as it struggles to hold above near-term support around 11,836 (61.8% retracement) to 11,843 (38.2% retracement), while Fed Funds Futures are now showing a close to zero percent probability for a rate-hike at the June 15 interest-rate decision.

- Fresh comments from Fed Chair Janet Yellen suggests that the central bank remains in no rush to further normalize monetary policy as the central bank head continues to highlight the low-inflation environment and remains concerned about the external risks surrounding the U.S. economy.

- Closing break below the Fibonacci overlap around 11,836 (61.8% retracement) to 11,843 (38.2% retracement) raises the risk for a move back towards the next downside region of interest around 11,745 (50% retracement) to 11,759 (23.6% retracement).

Click Here for the DailyFX Calendar

Get our top trading opportunities of 2016 HERE

Read More:

Gold Prices: Finding Resistance at Old Fibonacci Support

Gold and Silver Ownership Profiles Moderate from Records

S&P 500: Shrugs off Abysmal NFPs, Undergoing Consolidation Phase

EUR/USD Long Term Bull Trend Holding Support

--- Written by David Song, Currency Analyst

To contact David, e-mail dsong@dailyfx.com. Follow me on Twitter at @DavidJSong.

To be added to David's e-mail distribution list, please follow this link.