Talking Points:

- GBP/USD Clears Near-Term Range Ahead of U.K. Retail Sales Report.

- USDOLLAR Bid Ahead of FOMC Minutes as Fed Officials Endorse Higher Borrowing-Costs.

Avoid the pitfalls of trading by steering clear of classic mistakes. Review these principles in the "Traits of Successful Traders" series.

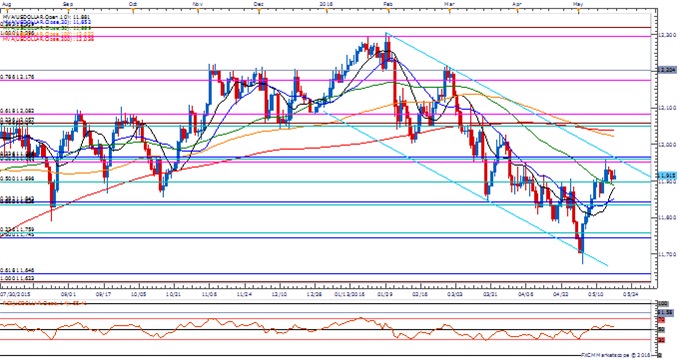

Chart - Created Using FXCM Marketscope 2.0

- Despite the limited market reaction to the U.K. Jobless Claims report, GBP/USD breaks out of the near-term range and threatens the downward trend carried over from August as fresh opinion polls show a narrowing risk for an EU-break up.

- With U.K. Retail Sales projected to rebound 0.6% in April, signs of a stronger-than-expected recovery may fuel the near-term advance in GBP/USD and put increased pressure on the Bank of England (BoE) to normalize monetary policy sooner rather than later as private-sector consumption remains one of the leading drivers of growth and inflation.

- A close above 1.4520 (38.2% retracement) may open up the next topside target around 1.4620 (50% expansion) to 1.4660 (50% retracement), followed by 1.4800 (61.8% retracement).

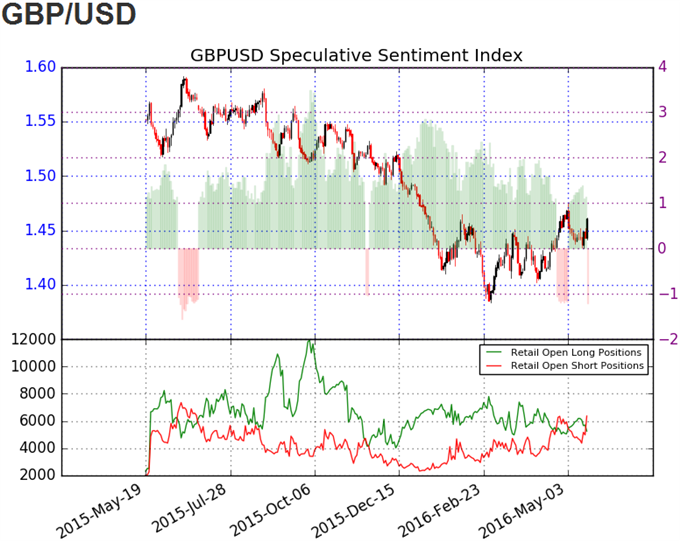

- The DailyFX Speculative Sentiment Index (SSI) shows the retail FX crowd remains net-long GBP/USD since the last BoE rate-decision on May 12, with the ratio marking near-term extremes in March as it climbed towards +2.50.

- The ratio currently sits at +1.15 as 54% of traders are long, while long positions have narrowed 5.3% from the previous week, with open interest 0.4% above the monthly average.

Why and how do we use the SSI in trading? View our video and download the free indicator here

USDOLLAR(Ticker: USDollar):

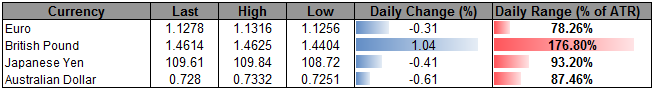

| Index | Last | High | Low | Daily Change (%) | Daily Range (% of ATR) |

|---|---|---|---|---|---|

| DJ-FXCM Dollar Index | 11915.43 | 11952.8 | 11913.22 | 0.01 | 73.25% |

Chart - Created Using FXCM Marketscope 2.0

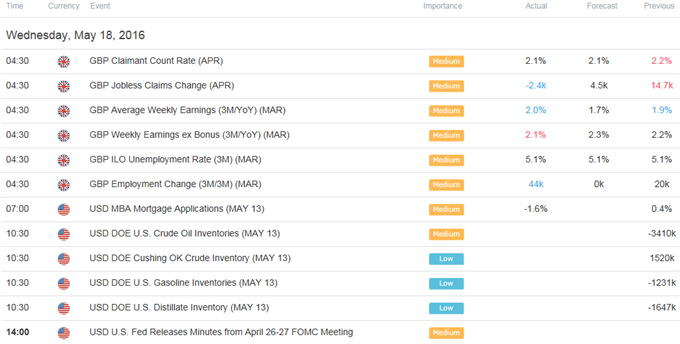

- The USDOLLAR pares the decline from earlier this week as Atlanta Fed President Dennis Lockhart and San Francisco Fed President John Williams see scope for at least two rate-hikes in 2016, with Fed Fund Futures now showing an 18% probability for a rate-hike at the June meeting.

- Nevertheless, the Federal Open Market Committee (FOMC) Minutes may have a limited impact on interest-rate expectations as the majority of the 2016 voting-members endorse a wait-and-see approach, and more of the same language from central bank officials may produce a choppy market reaction as Fed Chair Janet Yellen remains in no rush to implement higher borrowing-costs.

- Still waiting for a closing price below 11,898 (50% retracement) to open up the next downside region of interest coming in around 11,836 (61.8% retracement) to 11,843 (38.2% retracement) as the USDOLLAR remains largely capped by the Fibonacci overlap around 11,951 (38.2% expansion) to 11,965 (23.6% retracement).

Click Here for the DailyFX Calendar

Get our top trading opportunities of 2016 HERE

Check out FXCM’s Forex Trading Contest

Read More:

Gold Bulls Look to CPI, Fed Minutes for Solace

DailyFX Technical Focus: Short Term S&P and Gold Analysis

USD/CAD Technical Analysis: Time For Bulls To Prove Their Worth

--- Written by David Song, Currency Analyst

To contact David, e-mail dsong@dailyfx.com. Follow me on Twitter at @DavidJSong.

To be added to David's e-mail distribution list, please follow this link.